Crypto Daybook Americas, Crypto Daybook Americas, News Your day-ahead search for April 23, 2025

By Omkar Godbole (All instances ET until indicated in any other case)

For bitcoin bulls, it is a case of “heads I win, tails you lose.”

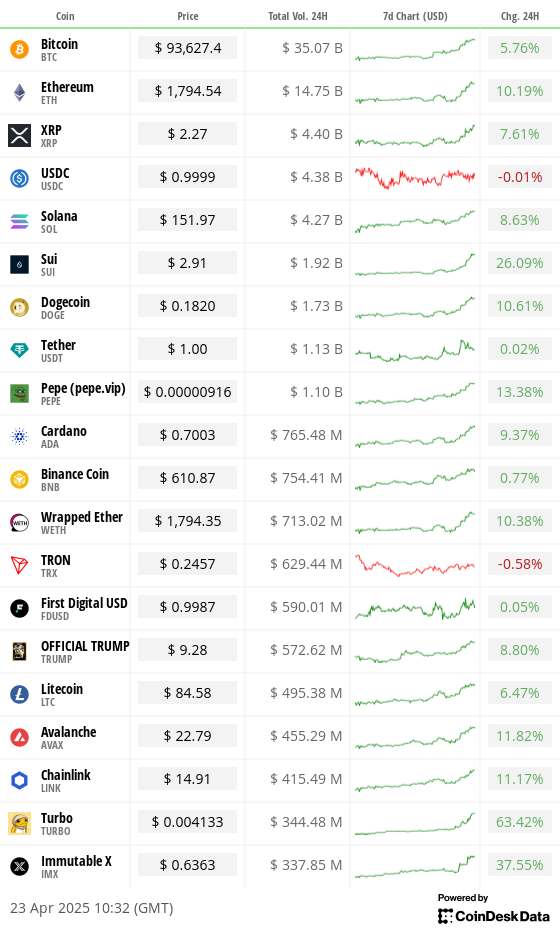

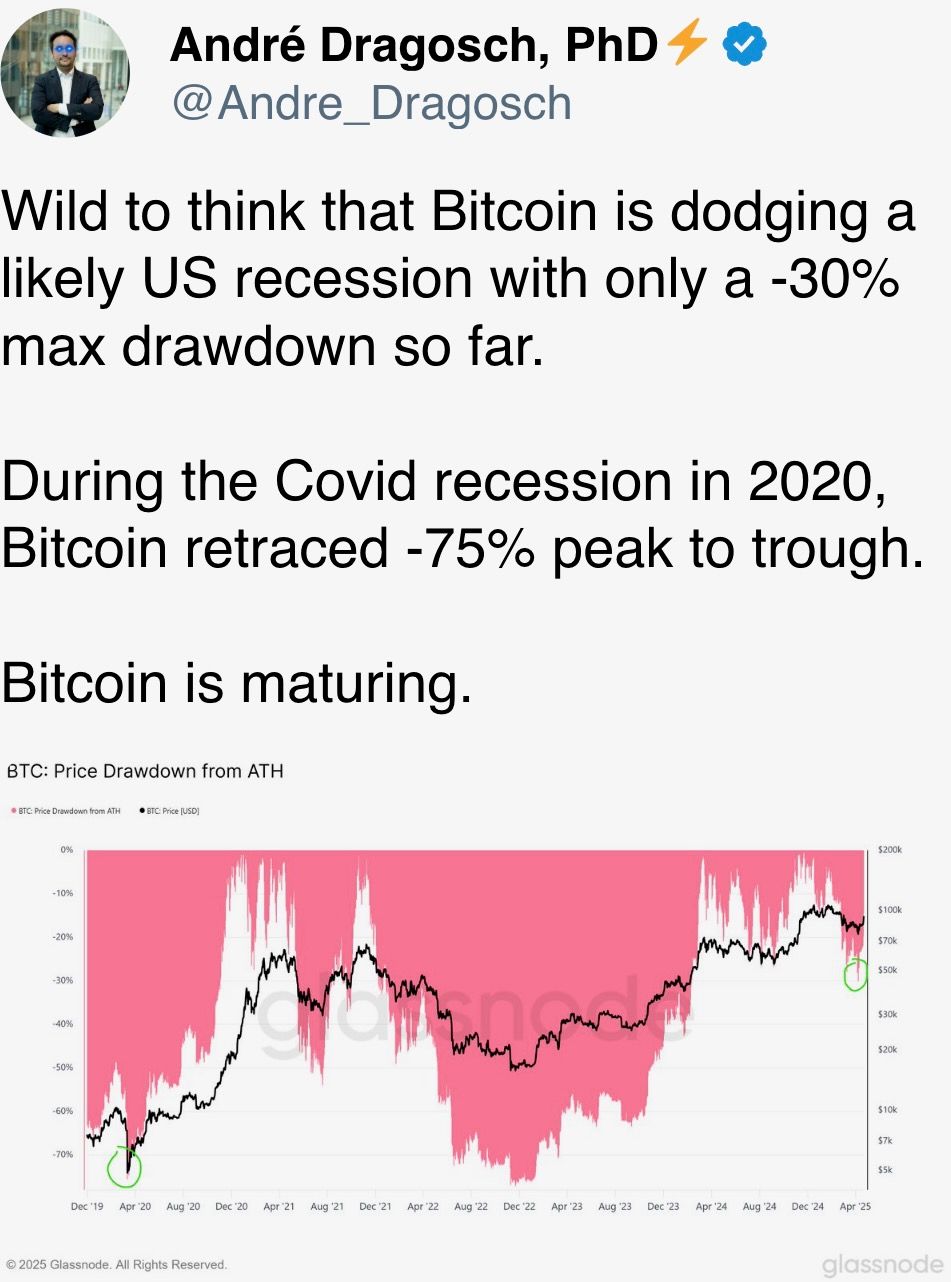

It’s risk-on-time and boding effectively for BTC, which rose above $94,000 to mark a greater than 50% retracement of the sell-off from document highs above $109,000 to $74,000.

The cryptocurrency has skilled a pointy rally up to now 24 hours, coinciding with President Donald Trump saying he does not intend to fireplace Fed Chair Jerome Powell and making conciliatory remarks on commerce tensions with China.

But BTC rose on Monday too. That was supposedly on haven demand as merchants offered the greenback, U.S. shares and bonds on the perceived risk to the Fed’s independence.

No surprise some analysts say the biggest cryptocurrency is concurrently a threat play resulting from its rising tech attraction and a haven akin to digital gold.

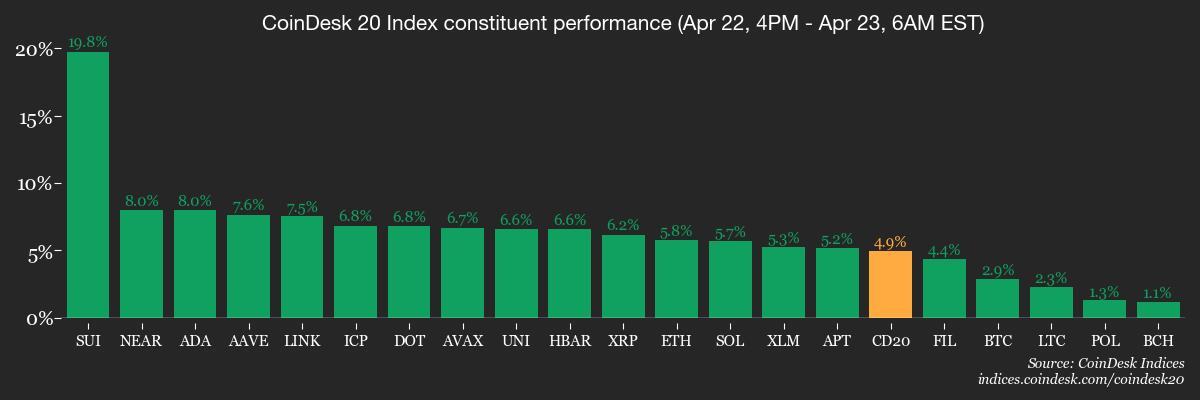

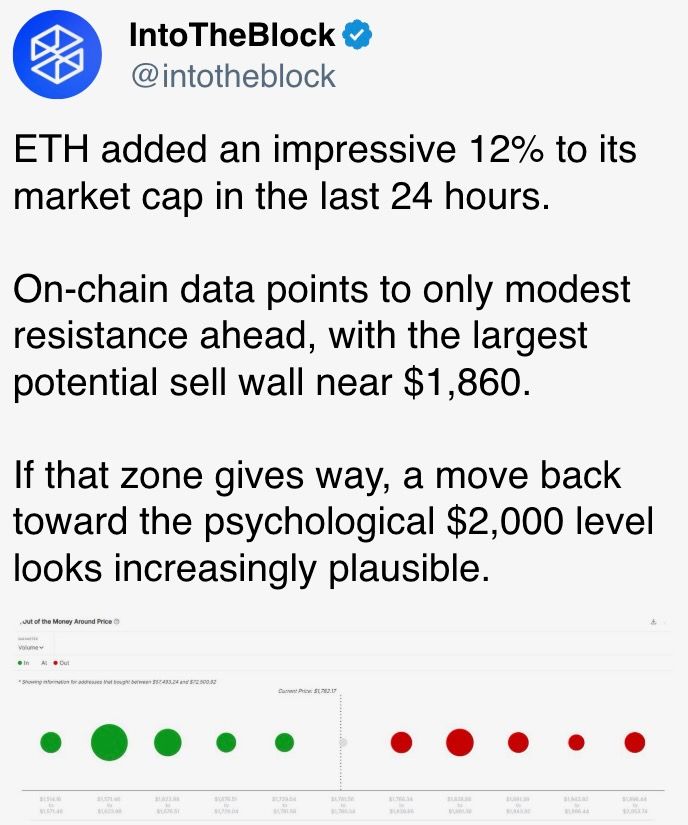

The newest surge additionally boosted morale within the wider crypto market. SUI, BONK, ENA, NEAR and AGLO have climbed greater than 20% in simply 24 hours. IMX surged over 40%, whereas ether (ETH), the largest altcoin, is buying and selling about 10% larger. Bitcoin’s dominance charge dropped barely, indicating a merchants’ renewed willingness to tackle threat.

In conventional markets, merchants are masking their USD quick positions, with some taking outright bullish bets on the greenback. This shift comes amid a decline in gold costs and a constructive upswing on Wall Street.

Supporting the case for a continued transfer larger in BTC is the renewed optimism about institutional adoption. The FT reported that Brandon Lutnick, son of U.S. Commerce Secretary Howard Lutnick, is working with SmoothBank, Tether and Bitfinex to capitalize on the crypto revival underneath the Trump administration.

“The $3 billion fund plans to raise an additional $350 million via convertible bonds, alongside a $200 million private equity round, with one clear directive: buy more Bitcoin, and buy it big,” in line with Singapore-based QCP Capital.

The announcement comes on the heels of decisive shift within the U.S. regulatory coverage. On Tuesday, the newly appointed SEC Chairman Paul Atkins reiterated that his prime precedence is establishing a transparent regulatory framework for digital property.

Elsewhere, DeFi Development Corp. deepened its SOL guess with a $11.5 million token buy. A crypto whale accrued ether, withdrawing $21.78 million price of tokens from Binance. Stay alert!

What to Watch

- Crypto:

- April 25, 1 p.m.: U.S. Securities and Exchange Commission (SEC) Crypto Task Force Roundtable on “Key Considerations for Crypto Custody“.

- April 28: Enjin Relaychain increases active validator slots to 25 from 15 to boost decentralization.

- April 29, 1:05 a.m.: BNB Chain (BNB) — BSC mainnet hardfork.

- April 30, 9:30 a.m.: ProShares expects its XRP ETF, providing publicity by way of futures and swap agreements, to start buying and selling on NYSE Arca.

- April 30, 10:03 a.m.: Gnosis Chain (GNO), an Ethereum sister chain, will activate the Pectra onerous fork on its mainnet at slot 21,405,696, epoch 1,337,856.

- Macro

- Day 3 of 6: World Bank (WB) and the International Monetary Fund (IMF) spring meetings in Washington.

- April 23, 8 a.m.: Mexico’s National Institute of Statistics and Geography releases retail gross sales knowledge.

- Retail Sales MoM Prev. 0.6%

- Retail Sales YoY Prev. 2.7%

- April 23, 9:45 a.m.: S&P Global releases (flash) U.S. April buying managers’ index (PMI) knowledge.

- Composite PMI Prev. 53.5

- Manufacturing PMI Est. 49.4 vs. Prev. 50.2

- Services PMI Est. 52.8 vs. Prev. 54.4

- April 24, 8:30 a.m.: The U.S. Census Bureau releases March manufactured sturdy items orders knowledge.

- Durable Goods Orders MoM Est. 2% vs. Prev. 0.9%

- Durable Goods Orders Ex Defense MoM Est. 0.2% vs. Prev. 0.8%

- Durable Goods Orders Ex Transp MoM Est. 0.2% vs. Prev. 0.7%

- April 24, 8:30 a.m.: The U.S. Department of Labor releases unemployment insurance coverage knowledge for the week ended April 19.

- Initial Jobless Claims Est. 221K vs. Prev. 215K

- Earnings (Estimates primarily based on FactSet knowledge)

Token Events

- Governance votes & calls

- Lido DAO is voting to extend the Delegate Incentivization Program (DIP) by way of This autumn with a $225,000 LDO funds. Voting ends on April 28.

- Uniswap DAO will vote on establishing a licensing and deployment framework for Uniswap v4 to speed up its adoption throughout a number of chains. The proposal grants the Uniswap Foundation a blanket exemption to deploy v4 on any DAO-approved chain and provides the Uniswap Accountability Committee authority to replace deployment information. Voting April 24-30.

- April 23, 12 p.m.: IOTA to host an X Spaces session titled IOTA Rebased Townhall.

- April 23, 9 p.m.: Manta Network to host a townhall meeting with its founders.

- April 24, 8 a.m.: Alchemy Pay to host an Ask Me Anything (AMA) session on its 2025 roadmap.

- April 24, 8 a.m.: Ronin to host a townhall meeting.

- April 30, 12 p.m.: Helium to host a community call meeting.

- Unlocks

- April 30: Optimism (OP) to unlock 1.89% of its circulating provide price $23.82 million.

- May 1: Sui (SUI) to unlock 2.28% of its circulating provide price $216.81 million.

- May 1: ZetaChain (ZETA) to unlock 5.67% of its circulating provide price $11.54 million.

- May 2: Ethena (ENA) to unlock 0.73% of its circulating provide price $13.97 million.

- May 7: Kaspa (KAS) to unlock 0.56% of its circulating provide price $13.82 million.

- May 9: Movement (MOVA) to unlock 2.04% of its circulating provide price $12.28 million.

- Token Launches

- April 23: Zora to airdrop its ZORA tokens.

- April 24: Initia (INIT) to be listed on Binance, CoinW, WEEX, KuCoin, MEXC, and others.

Conferences:

CoinDesk’s Consensus is going down in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

- Day 2 of three: Money20/20 Asia (Bangkok)

- April 23: Crypto Horizons 2025 (Dubai)

- Day 1 of two: Blockchain Forum 2025 (Moscow)

- Day 1 of three: Semafor’s World Economy Summit 2025 (Washington)

- April 24: Bitwise’s Investor Day for Bitcoin Standard Corporations (New York)

- April 26: Crypto Vision Conference 2025 (Manilla)

- April 26-27: Harvard Blockchain in Action Conference (Cambridge, Mass.)

- April 27: N Crypto Conference 2025 (Kyiv)

- April 27-30: Web Summit Rio 2025

- April 28-29: Blockchain Disrupt 2025 (Dubai)

- April 28-29: Staking Summit Dubai

- April 29: El Salvador Digital Assets Summit 2025 (San Salvador, El Salvador)

- April 29: IFGS 2025 (London)

- April 30-May 1: TOKEN2049 (Dubai)

Token Talk

By Shaurya Malwa

- Major memecoin venture Shib tokenized a shiba inu picture on the trending Base ecosystem platform Zora.

- “MAKE SHIB MEME AGAIN,” Shib stated in a publish on X in a nod to the “Make America Great Again” slogan, aiming to revive the meme tradition that propelled the token’s recognition in 2020.

- Shib stated the Zora token it minted was not tied to the SHIB token’s worth however centered on archiving the meme’s tradition.

- “This post is live on Zora — not for speculation, not a token tied to SHIB — but to preserve this content on-chain. We’re archiving our culture. One meme at a time,” the crew stated.

- Zora has gained traction up to now week following heavy social media promotion by Base creator Jesse Pollak, who spearheaded a marketing campaign to “tokenize everything,” or simply about any piece on content material, on the Coinbase Ventures-backed layer 2.

- Pollak’s amplifications of a number of Zora-created tokens drew consideration to the platform, with consumer rely and token creation setting information late final week. It attracted over 230,000 “new” merchants (or wallets that interacted with the platform for the primary time) on Sunday, knowledge reveals.

Derivatives Positioning

- Open curiosity in BTC and ETH perpetual futures listed on offshore exchanges has risen greater than value, signaling an inflow of cash into the market, which validates value beneficial properties.

- SUI, TRX, HBAR and BCH nonetheless see unfavorable funding charges, signaling a bias for shorts. Continued market energy could power these quick place holders to sq. off their bets, doubtlessly resulting in a pointy value rally within the tokens.

- Gains in XLM, DOGE, TON and TRX could also be fleeting: The unfavorable cumulative quantity delta for these cash factors to web promoting out there.

- On Deribit, merchants chased BTC calls at strikes $95,000 and $100,000. Options skews for BTC and ETH flipped bullish in favor of calls.

Market Movements:

- BTC is up 3.11% from 4 p.m. ET Tuesday at $94,258.40 (24hrs: +6.41%)

- ETH is up 5.75% at $1,795.84 (24hrs: +10.49%)

- CoinDesk 20 is up 5.05% at 2,767.83 (24hrs: +8.68%)

- Ether CESR Composite Staking Rate is up 4 bps at 3.02%

- BTC funding charge is at -0.0001% (-0.0624% annualized) on Binance

- DXY is unchanged at 98.88

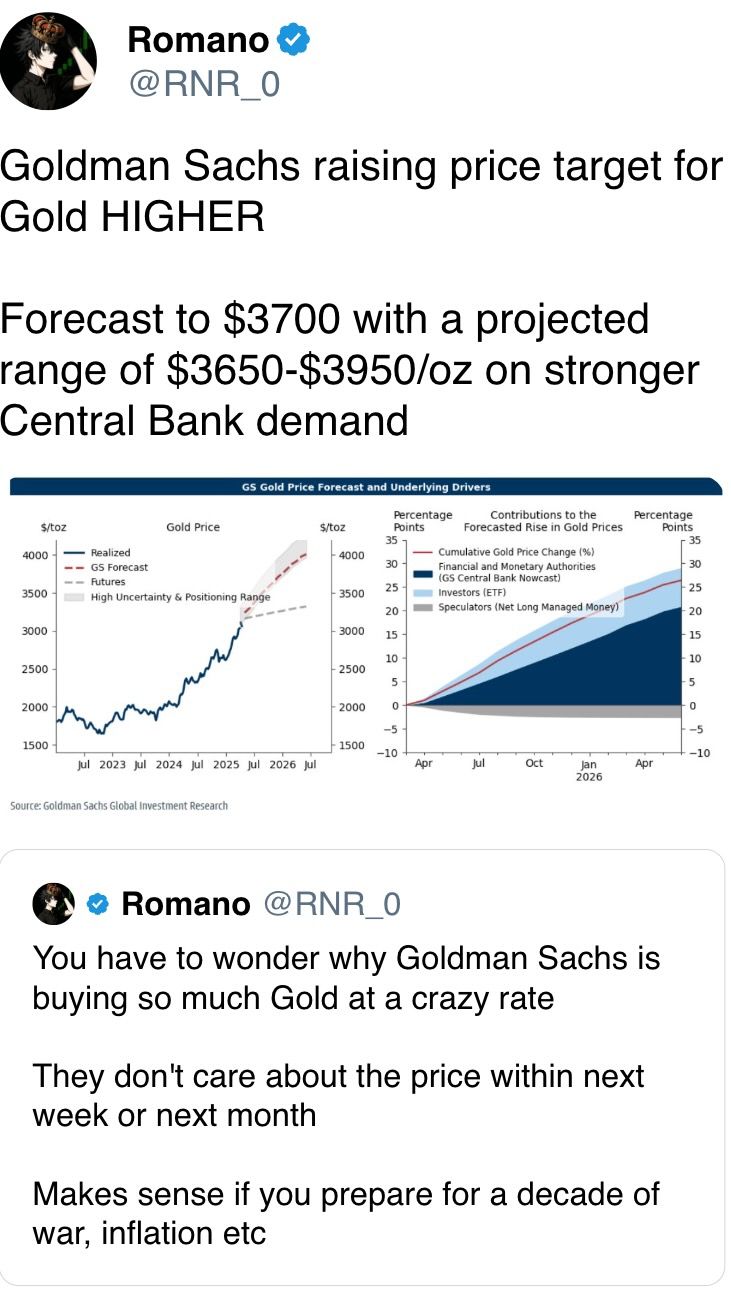

- Gold is down 1.43% at $3,352.00/oz

- Silver is up 0.36% at $33/oz

- Nikkei 225 closed +1.89% at 34,868.63

- Hang Seng closed +2.37% at 22,072.62

- FTSE is up 1.59% at 8,460.68

- Euro Stoxx 50 is up 2.71% at 5,096.05

- DJIA closed on Tuesday +2.66% at 39,186.98

- S&P 500 closed +2.51% at 5,287.76

- Nasdaq closed +2.71% at 16,300.42

- S&P/TSX Composite Index closed +1.24% at 24,306.00

- S&P 40 Latin America closed +2.52% at 2,444.63

- U.S. 10-year Treasury charge is down 5 bps at 4.35%

- E-mini S&P 500 futures are up 2.14% at 5,428.50

- E-mini Nasdaq-100 futures are up 2.46% at 18,838.00

- E-mini Dow Jones Industrial Average Index futures are up 1.71% at 40,031.00

Bitcoin Stats:

- BTC Dominance: 64.34 (-0.36%)

- Ethereum to bitcoin ratio: 0.01908 (1.44%)

- Hashrate (seven-day transferring common): 852 EH/s

- Hashprice (spot): $46.4 PH/s

- Total Fees: 6.27 BTC / $563,297

- CME Futures Open Interest: 141,010 BTC

- BTC priced in gold: 27.7 oz

- BTC vs gold market cap: 7.87%

Technical Analysis

- As the bitcoin value rally picks up tempo, the market may quickly see different cryptocurrencies like bitcoin money (BCH) put in larger beneficial properties.

- The BCH-BTC ratio could break above the bear market trendline to recommend a reversal larger.

- Such a breakout could usher in much more consumers, yielding a stronger rally.

Crypto Equities

- Strategy (MSTR): closed on Tuesday at $343.03 (+7.95%), up 3.34% at $354.50 in pre-market

- Coinbase Global (COIN): closed at $190 (+8.57%), up 4.18% at $197.95

- Galaxy Digital Holdings (GLXY): closed at C$18.21 (+18.4%)

- MARA Holdings (MARA): closed at $14.06 (+14.4%), up 3.77% at $14.59

- Riot Platforms (RIOT): closed at $7.12 (+13.2%), up 3.51% at $7.37

- Core Scientific (CORZ): closed at $6.92 (+8.29%), up 4.19% at $7.21

- CleanSpark (CLSK): closed at $8.77 (+17.4%), up 3.19% at $9.04

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $13.10 (+11.58%), up 5.5% at $13.82

- Semler Scientific (SMLR): closed at $33.28 (+11.57%), up 7.27% at $35.70

- Exodus Movement (EXOD): closed at $39.19 (+7.11%), up 2.3% at $40.09

ETF Flows

Spot BTC ETFs:

- Daily web stream: $912.7 million

- Cumulative web flows: $36.77 billion

- Total BTC holdings ~ 1.12 million

Spot ETH ETFs

- Daily web stream: $38.8 million

- Cumulative web flows: $2.28 billion

- Total ETH holdings ~ 3.31 million

Source: Farside Investors

Overnight Flows

Chart of the Day

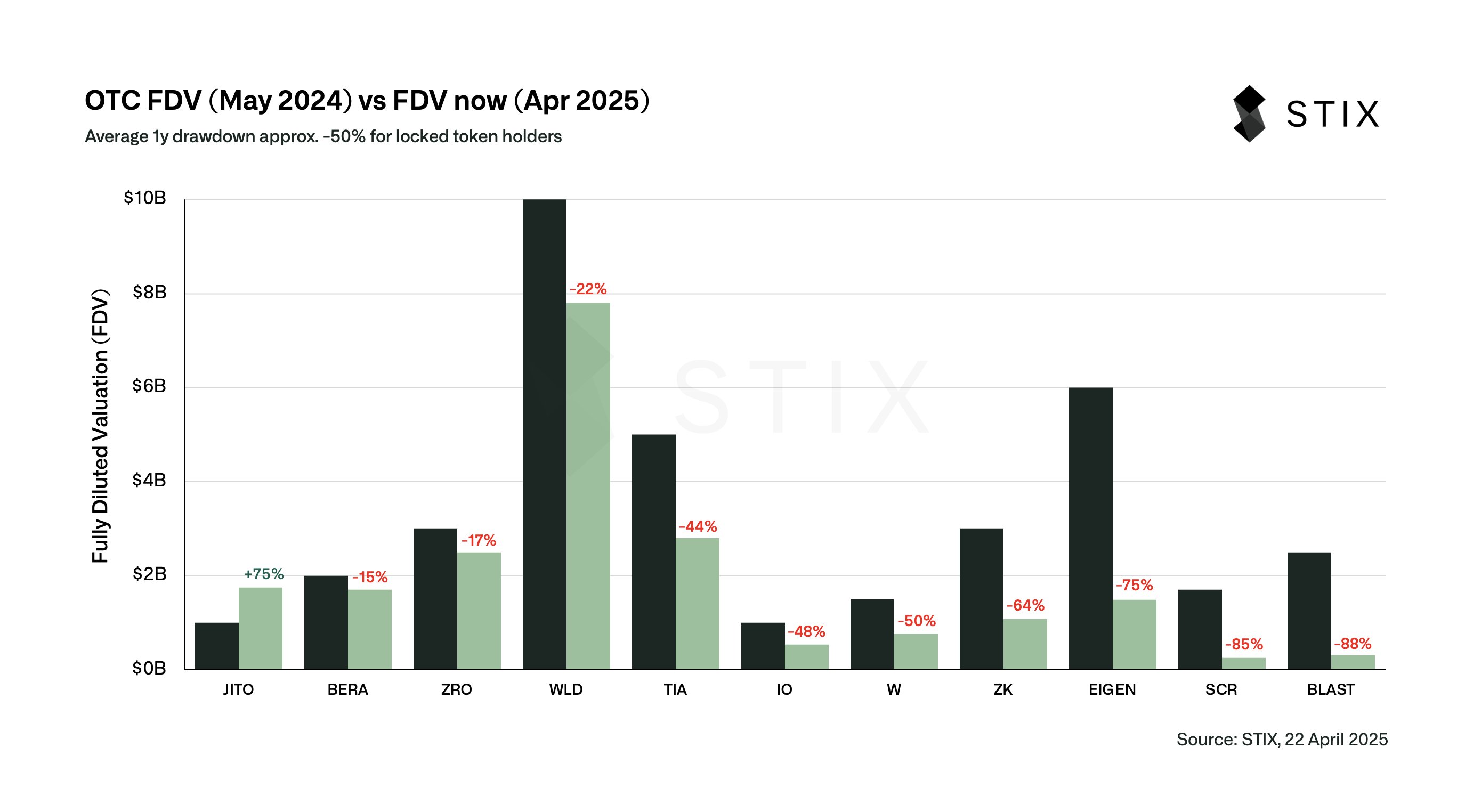

- The chart compares the totally diluted valuations (FDV) of assorted tokens between May 2024 and April 2025.

- The common drawdown has been 50% over a one-year interval, implying losses for these holding locked tokens.

- “Meaning on average, holders had the opportunity to exit locked positions at 2x current spot prices last year,” Taran Sabharwal, founding father of OTC liquidity platform STIX, stated on X.

While You Were Sleeping

- China, BRICS Will ‘Defend’ Global Order as Trump Withdraws, Brazil Says (Financial Times): Brazil’s chief overseas coverage adviser stated Trump’s retreat from multilateralism is strengthening BRICS, noting that “a world order without Washington is impossible.”

- Bitcoin Becomes Fifth-Largest Global Asset, Surpasses Google’s Market Cap (CoinDesk): Bitcoin rose previous $94,000, broke by way of key technical ranges and outperformed the Nasdaq 100 amid easing U.S.-China commerce tensions and renewed energy in tech shares.

- Cantor Nears $3B Crypto Venture With SoftBank and Tether (FT): Cantor Equity Partners, which raised $200 million in January, will assist launch 21 Capital, a brand new agency seeded with $3 billion in BTC from Softbank, Tether and Bitfinex.

- BOJ to Raise Rates in Q3 Though Trump Tariffs Will Disrupt Policy Normalization (Reuters): 84% of economists surveyed see no BOJ charge hike earlier than July, whereas expectations for a third-quarter improve fell sharply resulting from tariff-driven uncertainty and worsening earnings forecasts.

- Bitcoin Futures Open Interest Surge Shows Investor Confidence on Trade Deals, Powell (CoinDesk): The cumulative notional open curiosity, or the greenback worth of the variety of energetic bets in BTC perpetual futures, rose by 10% to $17.83 billion.

- China Has an Army of Robots on Its Side in the Tariff War (The New York Times): China’s lead in manufacturing unit robotics helps maintain export costs low, giving it an edge in commerce conflicts, although issues over job losses and social impacts stay.

In the Ether

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More