Finance, Ether Ether stays prone to experiencing a number of on-chain liquidations.

An Ethereum consumer saved a number of MakerDAO positions from the brink of a $360 million liquidation cascade on Tuesday, including collateral on the closing hour as the worth of ETH tumbled.

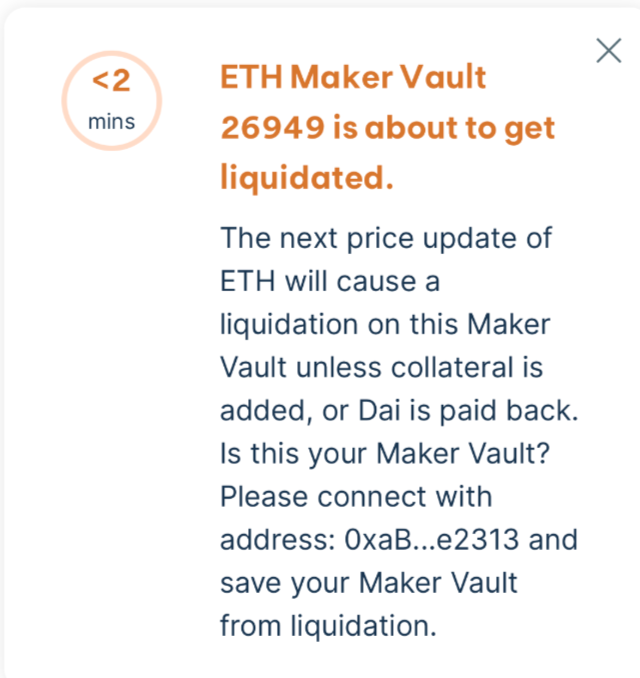

One of the positions had a liquidation value of $1,928, this was triggered alongside a market plunge throughout U.S. buying and selling hours. The ETH was lower than two minutes away from being liquidated and offered at a MakerDAO public sale till the pockets proprietor deposited 2,000 ETH from Bitfinex as further collateral. It additionally paid again $1.5 million price of the DAI stablecoin.

The pockets in query took some unexpectedly by saving the place as they’d beforehand been inactive since November.

That specific place isn’t out of the woods but; will probably be liquidated if ETH drops to $1,781 or till the proprietor provides extra collateral. Ether is at present buying and selling at $1,928 having bounced from Monday’s low of $1,788.

Another pockets, which based on X account Lookonchain is suspected of being the Ethereum Foundation, deposited 30,098 ETH ($56.08M) to decrease the liquidation value of its place to $1,127.

Whilst lots of of tens of millions of {dollars} price of liquidations are pretty widespread throughout derivatives markets, decentralized finance (DeFi) protocols like MakerDAO use solely spot property. This implies that when a liquidation takes place, DeFi liquidity is unable to deal with the skew of spot asset provide. This does not happen on spinoff exchanges as there may be sometimes extra quantity and liquidity pushed by leverage.

In this case, simply one in every of nine-figure liquidation on MarkerDAO would seemingly ship the ETH value tumbling, liquidated the opposite susceptible place in its path.

DefiLlama exhibits that there’s $1.3 billion in liquidatable property on Ethereum, with $352 million of that inside 20% of the present value.

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More