Markets, Bitcoin, Markets, Nasdaq Stretched positioning and Japanese institutional exercise may cap beneficial properties within the yen, paving the best way for a bounce in Nasdaq and bitcoin.

It could also be a coincidence, however the latest decline within the Nasdaq and bitcoin (BTC) coincides with a pointy rise in Japanese government bond yields and the strengthening of the safe-haven Japanese yen (JPY), paying homage to the market dynamics seen in early August.

There may very well be a causation right here, as, for many years, the low-yielding yen propped up international asset costs. The ongoing rise within the Japanese yen might have had a hand within the latest danger aversion on Wall Street and within the crypto market.

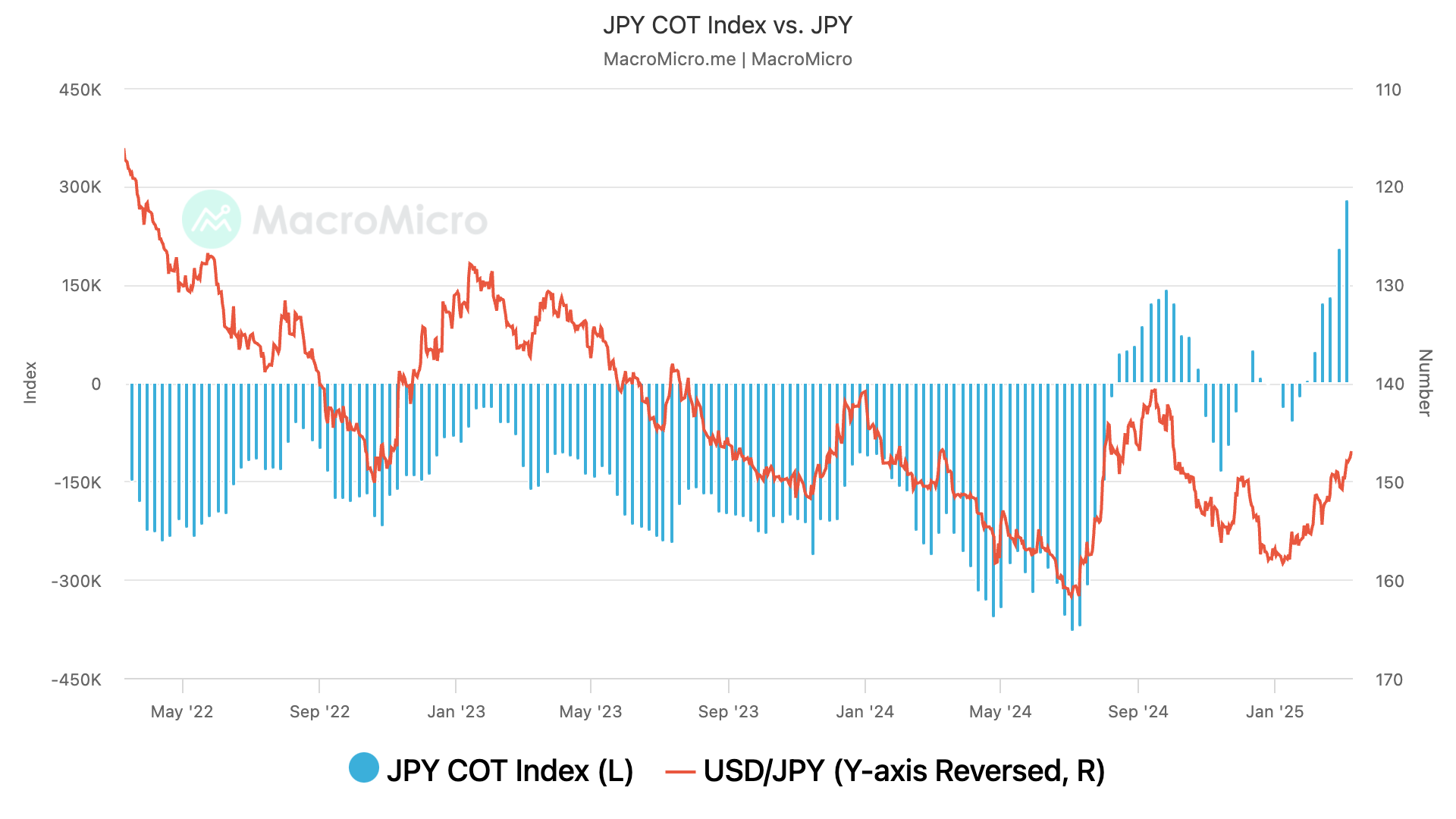

That stated, the bullish positioning within the Japanese yen seems overstretched, with speculators holding report longs final week, based on the CFTC information tracked by MacroMicro. Such excessive bullish positioning, representing a collective perception in a continued transfer greater within the asset, units the stage for disappointment, following, which a mass unwinding of longs unfolds, resulting in a fast bearish reversal.

In different phrases, the yen’s rise may stall for now, providing aid to danger property, together with Nasdaq and bitcoin.

“We are now cautious on chasing further JPY strength, given stretched speculative positioning as well as strong dip-buying appetite from the domestic community,” Morgan Stanley’s G10 FX Strategy staff stated in a notice to shoppers late Friday.

Strategists defined that many Japanese traders use the Nippon Individual Savings Account (NISA) scheme to snap up overseas property throughout risk-off, inadvertently slowing the tempo of JPY appreciation. Additionally, the general public pension system tends to go towards the development, rebalancing out of JPY property.

“Indeed, such scenario happened in last August after a sharp appreciation of the JPY and the pronounced sell-off in equities,” strategists famous.

Let’s see if historical past repeats itself, triggering a renewed risk-on sentiment for Nasdaq and bitcoin. The USD/JPY pair turned up following the July and early August slide to 140, ultimately rising to 158.50 by January. BTC turned up as properly from the early August crash to $50,000, rising to new report highs above $108,000 in January.

At press time, bitcoin traded close to $80,300, representing a month-to-date decline of practically 5%, extending February’s 17.6% slide. At one level early Tuesday, costs dipped to $76,800, based on CoinDesk information.

Meanwhile, USD/JPY traded at 147.23, having put in a five-month low of 145.53 early Tuesday, TradingView information present.

Temporary respite?

While the stretched bull positioning and institutional flows recommend aid forward, these elements might do little to change the broader bullish outlook for JPY, which is backed by a narrowing U.S.-Japanese bond yield differential.

So, danger asset bulls must be vigilant for indicators of volatility within the yen and the broader monetary markets.

The chart reveals the unfold between yields on the 10-year U.S. and Japanese authorities bonds.

The unfold has narrowed to 2.68% in a JPY-positive method, reaching the bottom since August 2022. Plus, it has dived out of a macro uptrend, suggesting a serious bullish shift within the JPY outlook.

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More