Markets, QuickNews, Markets, Futures Futures expiring on Friday have slipped into a reduction, reflecting demand weak point.

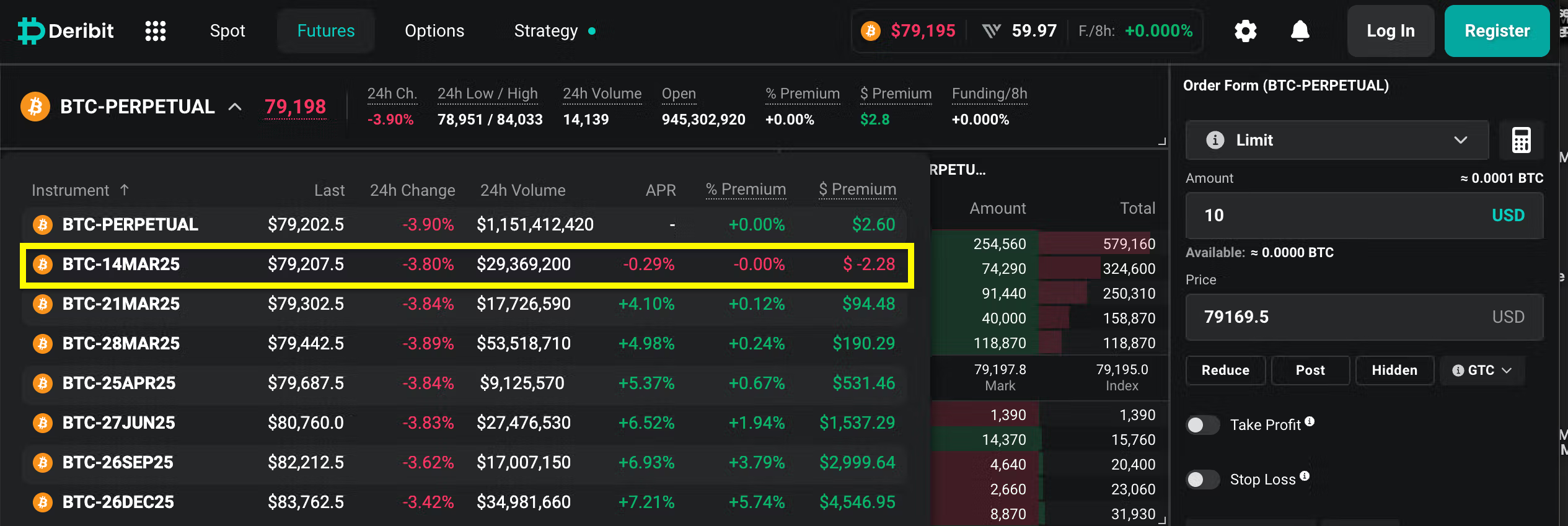

Deribit-listed bitcoin (BTC) futures set to run out this Friday now commerce marginally under the alternate’s index value, flashing a reduction in an indication of weak demand for the cryptocurrency.

“What we have seen is that near-tenor (7d and shorter) yields have dipped to the negative for the first time in over a year,” Andrew Melville, a analysis analyst at Block Scholes advised CoinDesk in a Telegram chat. “This means that futures prices are trading below spot, which we take as a significantly bearish indicator.”

Deribit is the world’s main crypto choices alternate and a most popular venue for stylish merchants seeking to make use of artificial methods involving futures, choices and spot markets.

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More