Crypto Daybook Americas, Crypto Daybook Americas Your day-ahead seek for April 10, 2025

By Omkar Godbole (All events ET besides indicated in another case)

The crypto market consolidated on Wednesday’s tariff pause-spurred price bounce with memecoins, AI and DeFi tokens standing out as a result of the best-performing crypto sub-sectors. Coins along with HYPE, HBAR and SHIB led the restoration.

Bullish technical patterns and a sharp in a single day pullback in Treasury market volatility, as represented by the MOVE index, suggested extra options are throughout the offing. The China-sensitive Australian dollar extended Wednesday’s purchase, offering optimistic cues to risk property. U.S. equity futures, nonetheless, did not replicate that optimism, shopping for and promoting better than 1% lower.

Another phrase of warning confirmed in derivatives data. LTC, TON, BCH, BNB and PEPE had been the one money with 24-hour growth in open curiosity, validating price restoration. Open curiosity in several majors cryptocurrencies, along with BTC and ETH, fell, a sign the restoration was primarily led by the unwinding of bearish bets and by no means latest bullish positioning.

President Donald Trump’s selection to spice up tariffs on China to 125% and reduce others to 10% for 90 days nonetheless leaves the U.S. with a median import tax price of 24% versus 27% sooner than Thursday. That’s nonetheless, anti-growth, pro-inflation and anti-risk property, in line with Bloomberg.

In broader crypto market data, the SEC printed the 19b-4 submitting by Cboe BZX Exchange to itemizing the Fidelity Solana Fund throughout the Federal Register. That’s talked about to ship the regulator one step nearer to itemizing the SOL ETF throughout the U.S.

The minutes of the Federal Reserve’s March meeting confirmed consensus amongst policymakers over the prospect of the financial system moving into stagflation, characterised by better inflation and slower growth, with some members saying “difficult tradeoffs” would possibly lie ahead of the central monetary establishment.

The focus right now will most likely be on the U.S. shopper price index data for March, which is forecast to have elevated by merely 0.1% month-on-month, the slowest tempo in eight months, in line with FXStreet. A cushty print may be dismissed as backward-looking, considering the commerce battle escalated further simply currently. On the alternative hand, a hotter-than-expected finding out would possibly elevate Treasury yields and the dollar. Stay alert!

What to Watch

Crypto

April 10, 10:30 a.m.: Status conference for former Terraform Labs CEO Do Kwon on the U.S. District Court for the Southern District of New York.

April 11, 1 p.m.: U.S. SEC Crypto Task Force Roundtable on “Tailoring Regulation for Crypto Trading” in Washington.

April 17: EigenLayer (EIGEN) prompts slashing on Ethereum mainnet, imposing penalties for operator misconduct.

Macro

April 10, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases March shopper price inflation data.

Core Inflation Rate MoM Est. 0.3% vs. Prev. 0.2%

Core Inflation Rate YoY Est. 3% vs. Prev. 3.1%

Inflation Rate MoM Est. 0.1% vs. Prev. 0.2%

Inflation Rate YoY Est. 2.6% vs. Prev. 2.8%

April 10, 8:30 a.m.: The U.S. Department of Labor releases unemployment insurance coverage protection data for the week ended April 5.

Initial Jobless Claims Est. 223K vs. Prev. 219K

April 10, 10:00 a.m.: U.S. Senate Banking Committee hearing on the nomination of Michelle Bowman as Federal Reserve Vice Chair for Supervision. Livestream link.

April 11, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases March producer price inflation data.

Core PPI MoM Est. 0.3% vs. Prev. -0.1%

Core PPI YoY Est. 3.6% vs. Prev. 3.4%

PPI MoM Est. 0.2% vs. Prev. 0%

PPI YoY Est. 3.3% vs. Prev. 3.2%

April 14: Salvadoran President Nayib Bukele will likely be part of U.S. President Donald Trump on the White House for an official working visit.

Earnings (Estimates based mostly totally on FactSet data)

April 22: Tesla (TSLA), post-market

April 30: Robinhood Markets (HOOD), post-market

Token Events

Governance votes & calls

Spartan Council is voting on raising the liquidation ratio for SNX solo stakers, with an preliminary enhance to 250% on April 11, then to 500% on April 18 and “high enough to deprecate solo SNX staking” on April 21. Voting ends April 19.

Lido DAO is discussing onboarding credit delegation protocol Twyne into the Lido Alliance. Twyne targets to develop stETH’s use situations and is requesting strategic endorsement, promotional help and technical steering from Lido.

April 10, 10 a.m.: Hedera to host a community call discussing the HBR Foundation changing into a member of ERC3643, the non-profit’s necessities, and the Header Asset Tokenization Studio.

April 11, 3 p.m.: Zcash to host a metropolis hall on lockbox distribution & governance.

April 14, 10 a.m.: Stacks to host a livestream with newest bulletins from the mission.

Unlocks

April 10: Internet Computer (ICP) to unlock 0.57% of its circulating present worth $13.54 million.

April 12: Aptos (APT) to unlock 1.87% of its circulating present worth $51.69 million.

April 12: Axie Infinity (AXS) to unlock 5.68% of its circulating present worth $21.73 million.

April 15: Starknet (STRK) to unlock 4.37% of its circulating present worth $16.71 million.

April 16: Arbitrum (ARB) to unlock 2.01% of its circulating present worth $26.27 million.

April 18: Official Trump (TRUMP) to unlock 20.25% of its circulating present worth $324.35 million.

Token Launches

April 10: Stacks (STX) to be listed on Bitfinex.

April 10: Streamr (DATA) to be listed on Binance.US.

April 10: Babylon (BABY) to be listed on Binance, Bitget, Bybit, Bitrue, KuCoin, OKX, and others.

April 10: Ren (REN), KonPay (KON) and Symbol (XYM) to be delisted from Bybit.

April 22: Hyperlane to airdrop its HYPER tokens.

Conferences:

Day 3 of three: Paris Blockchain Week

Day 2 of two: FIBE Fintech Festival Berlin 2025

Day 2 of two: Mexico Finance & Fintech Summit 2025 (Mexico City)

Day 2 of two: Middle East Resilient Banking and Payments Symposium 2025 (Abu Dhabi)

April 10: Bitcoin Educators Unconference (Nashville)

April 10: FinXtex Malaysia 2025 (Kuala Lumpur)

April 10: Institutional Crypto Conference (New York)

April 10: SheFi Sumit 2025 (Seoul)

Day 1 of two: BITE-CON 2025 Conference (Miami)

Day 1 of two: 2025 Fintech and Financial Institutions Research Conference (Philadelphia)

April 11-12: Strategy’s OPNEXT Conference (Tysons, Va.)

April 12: Ethereum Argentina (Córdoba)

April 12-13: DeSci London 2025

Token Talk

By Shaurya Malwa

DeFi-focused upstart Berachain has recorded internet outflows of $320 million before now week, most likely probably the most amongst all networks, adopted by Arbitrum with merely $30 million in exits.

Berachain’s every day energetic clients dropped from a extreme of 630,000 on March 3, according to TokenTerminal, to easily over 300,000 as of April 8.

The neighborhood’s BERA token is down 40% in each week, shrinking its market cap to $465 million and completely diluted price to $2.1 billion. It acquired a 12% elevate on Thursday after Trump’s 90-day tariff pause, but it surely certainly’s nonetheless a far cry from good news.

Total price locked is down 23% to $2.7 billion from a peak of $3.5 billion on March 26, DefiLlama data reveals. Still, the blockchain enjoys a cult following and is hyped amongst retail retailers making it one to take a look at when market conditions improve.

Meanwhile, Ethereum layer-2 Base, backed by Coinbase, has emerged as the best neighborhood with over $186 million in internet inflows before now 10 days.

Derivatives Positioning

BTC, ETH annualized futures basis held common above 5% all through the newest rout, signaling resilient market sentiment.

Put skews for the two largest cryptocurrencies on Deribit have weakened, nonetheless proceed to level out draw again fears out to the June end expiry.

Flows featured purchases of $100K BTC calls expiring in December, reflecting a bullish long-term outlook.

Market Movements:

BTC is down 1.74% from 4 p.m. ET Wednesday at $81,748.51 (24hrs: +6.2%)

ETH is down 4.65%% at $1,595.49 (24hrs: +7.78%)

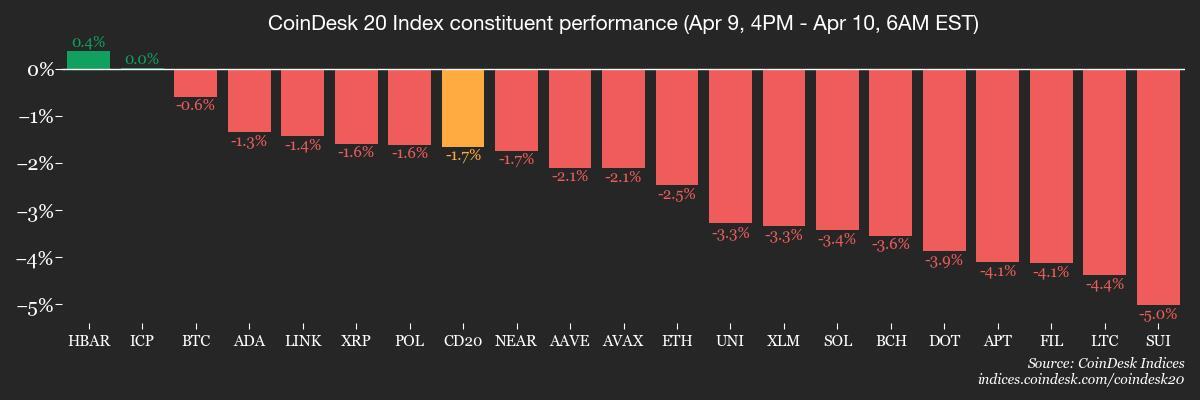

CoinDesk 20 is down 1.72% at 2,372.30 (24hrs: +7.55%)

Ether CESR Composite Staking Rate is unchanged at 3.69%

BTC funding price is at 0.0043% (4.7085% annualized) on Binance

DXY is down 0.85% at 102.03

Gold is up 2.23% at $3,124.6/oz

Silver is up 1.68% at $30.83/oz

Nikkei 225 closed +9.13% at 34,609.00

Hang Seng closed +2.06% at 20,681.78

FTSE is up 3.97% at 7,984.64

Euro Stoxx 50 is up 5.33% at 4,868.37

DJIA closed on Wednesday +7.87% at 40,608.45

S&P 500 closed +9.52% at 5,456.90

Nasdaq closed +12.16% at 17,124.97

S&P/TSX Composite Index closed +5.42% at 23,727.00

S&P 40 Latin America closed +7.02% at 2,330.16

U.S. 10-year Treasury price is down 7 bps at 4.29%

E-mini S&P 500 futures are down 2.13% at 5,374.00

E-mini Nasdaq-100 futures are down 2.44% at 18,818.50

E-mini Dow Jones Industrial Average Index futures are down 1.58% at 40,189.00

Bitcoin Stats:

BTC Dominance: 63.47 (0.34%)

Ethereum to bitcoin ratio: 0.01953 (-3.36%)

Hashrate (seven-day transferring widespread): 899 EH/s

Hashprice (spot): $41.08

Total Fees: 5.6 BTC / $438,630

CME Futures Open Interest: 134,545

BTC priced in gold: 26.2 oz

BTC vs gold market cap: 7.47%

Technical Analysis

The per barrel prices for West Texas Intermediate crude oil have dropped beneath the long-held help at $67, suggesting further losses ahead.

Sliding crude would possibly help compensate for the inflationary have an effect on of Trump’s tariffs, serving to central banks, along with the Fed, to cut charges of curiosity and help risk property in case of a critical market instability.

Crypto Equities

Strategy (MSTR): closed on Wednesday at $2296.86 (+24.76%), down 3.64% at $286.06 in pre-market

Coinbase Global (COIN): closed at $177.09 (+16.91%), down 2.31% at $173

Galaxy Digital Holdings (GLXY): closed at C$15.19 (+14.9%)

MARA Holdings (MARA): closed at $12.31 (+17.02%), down 2.44% at $12.01

Riot Platforms (RIOT): closed at $7.38(+12.84%), down 1.56% at $7.26

Core Scientific (CORZ): closed at $7.51 (+15.36%), down 3.6% at $7.24

CleanSpark (CLSK): closed at $7.63 (+13.2%), down 2.75% at $7.42

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $13.06 (+13.66%)

Semler Scientific (SMLR): closed at $35.16 (+9.98%)

Exodus Movement (EXOD): closed at $43.14 (+7.47%), up 8.92% at $46.99

ETF Flows

Spot BTC ETFs:

Daily internet stream: -$127.2 million

Cumulative internet flows: $35.61 billion

Total BTC holdings ~ 1.11 million

Spot ETH ETFs

Daily internet stream: -$11.2 million

Cumulative internet flows: $2.36 billion

Total ETH holdings ~ 3.37 million

Source: Farside Investors

Overnight Flows

Chart of the Day

The chart reveals the breakdown of BTC selections block trades on Deribit. Block trades are huge trades executed on over-the-counter tech platforms after which listed on Deribit.

Selling identify selections has been the popular play, a sign market members are betting on a drop in volatility and sluggish price ascent.

While You Were Sleeping

China State Media Hints at Rate Cuts to Counter Trump’s Tariffs (Bloomberg): Front-page commentary throughout the state-run Securities Daily urged price cuts and reduce monetary establishment reserve requirements to fight deflation and offset Trump’s tariffs.

Russia, United States to Hold Talks on Diplomatic Missions (Reuters): Talks in Istanbul purpose to resolve embassy factors, along with restrictions on diplomat actions and frozen property comparable to consulates, commerce missions, and historic estates.

Crypto Investors Flee Spot Bitcoin, Ether ETFs on Tariff-Driven Uncertainty (CoinDesk): U.S.-listed spot BTC and ETH ETFs observed outflows Wednesday while cryptocurrency prices surged.

Bitcoin Eyes $87K After Double Bottom Breakout; Dogecoin, XRP Bulls Look to Establish Control (CoinDesk): Bitcoin rebounded from two newest lows near $74,600 and broke above $80,800, a switch analysts say would possibly push it in the direction of $87,000.

Binance Gains Market Share as Bitcoin Volume Declined 77% From Yearly Peak: CryptoQuant (CoinDesk): A amount drop of such magnitude suggests retailers and merchants are dropping curiosity or confidence.

NFT Marketplace Magic Eden Buys Trading App Slingshot (CoinDesk): Slingshot permits shopping for and promoting tokens from a single USDC steadiness, eradicating the need for pockets setup, gasoline costs or transferring property all through blockchains, growing Magic Eden previous Solana to all chains.

In the Ether

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More