Crypto Daybook Americas, Crypto Daybook Americas Your day-ahead seek for April 9, 2025

By Omkar Godbole (All situations ET till indicated in every other case)

Markets keep squarely centered on the U.S.-China commerce tussle and headlines from every worldwide areas.

Bitcoin fell beneath $75,000 in the middle of the Asian morning, with S&P 500 futures nursing a 2% loss after the U.S. lifted the total levy on the world’s second-largest economy to 104%. The Australian dollar, a China-sensitive commodity overseas cash, fell to a five-year low of 0.5913 in opposition to the greenback and the volatile U.S. Treasury market threatened a USD liquidity squeeze.

Sentiment improved significantly after China’s State Council Information Office released a white paper on the tensions that talked about Beijing is ready to talk on factors. Noticeably absent have been up to date retaliatory taxes on U.S. imports. BTC bounced once more to $77,000 alongside a sharp restoration inside the Aussie dollar and S&P 500 futures.

Still, the sustainability of the restoration is under question as China’s suggestions previous the headlines have been strong and advocate the federal authorities is unlikely to blink any time rapidly. For event, the doc talked about China won’t be bullied and the U.S. may need to current respect and equality if it wishes to resolve the difficulty. The nation will take measures to safeguard its rights and pursuits, it talked about.

Besides, persistent volatility in bonds, triggered by the supposed unwinding of carry trades and fears of sticky inflation, may work in opposition to a sustained restoration inside the menace property. A rising number of observers, along with economist Nouriel Roubini, say markets are too optimistic in pricing an aggressive Fed easing, and central monetary establishment assistance will come solely after President Donald Trump tempers his rhetoric. Meanwhile, Bank of Japan Governor Kazuo Ueda talked about interest-rate hikes will continue if the monetary system improves as anticipated, together with the should be alert to commerce tensions.

In the broader crypto market, BlocScale, a launchpad to onboard duties and community-driven token introductions to XRP Ledger, continued to make waves, with strong uptake for the seed sale of its native token BLOC. “With over 35% of the seed sale allocation already claimed, BlocScale Launchpad is gaining significant traction from early-stage investors, developers, and XRP enthusiasts looking to be part of something groundbreaking,” it talked about.

The TRUMP token, associated to President Trump, traded at file lows near $7.5 inside the wake of big selling by whales early this week. It is now down 90% from its file extreme, with a $360 million unlock due later this month. Stay Alert!

What to Watch

Crypto:

April 9: The Mercury network upgrade will get utilized to the Neutron (NTRN) mainnet, migrating it from Cosmos Hub’s Interchain Security to a totally sovereign proof-of-stake neighborhood.

April 9, 10 a.m.: U.S. House Financial Services Committee hearing on updating U.S. securities authorized pointers to bear in mind digital property. Livestream link.

April 10, 10:30 a.m.: Status conference for former Terraform Labs CEO Do Kwon on the U.S. District Court for the Southern District of New York.

April 11, 1 p.m.: U.S. SEC Crypto Task Force Roundtable on “Tailoring Regulation for Crypto Trading” in Washington.

Macro

April 9, 8:00 a.m.: Mexico’s Instituto Nacional de Estadística y Geografía (INEGI) releases March shopper worth inflation data.

Core Inflation Rate MoM Prev. 0.48%

Core Inflation Rate YoY Prev. 3.65%

Inflation Rate MoM Prev. 0.28%

Inflation Rate YoY Prev. 3.77%

April 9, 11:30 a.m.: U.S. Senate to vote on ending the debate for Paul Atkins’ nomination as SEC Chair. If invoked, affirmation vote at 7 p.m.

April 9, 12:01 p.m.: China’s 34% retaliatory tariffs on U.S. imports take affect.

April 9, 2:00 p.m.: The Fed releases minutes of the FOMC meeting held March 18-19.

April 9, 9:30 p.m.: China’s National Bureau of Statistics (NBS) releases March’s Consumer Price Index (CPI) report.

Inflation Rate MoM Prev. -0.2%

Inflation Rate YoY Est. 0% vs. Prev. -0.7%

PPI YoY Est. -2.3% vs. Prev. -2.2%

April 10, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases March shopper worth inflation data.

Core Inflation Rate MoM Est. 0.3% vs. Prev. 0.2%

Core Inflation Rate YoY Est. 3% vs. Prev. 3.1%

Inflation Rate MoM Est. 0.1% vs. Prev. 0.2%

Inflation Rate YoY Est. 2.6% vs. Prev. 2.8%

April 10, 8:30 a.m.: The U.S. Department of Labor releases unemployment insurance coverage protection data for the week ended April 5.

Initial Jobless Claims Est. 223K vs. Prev. 219K

April 10, 10:00 a.m.: U.S. Senate Banking Committee hearing on the nomination of Michelle Bowman as Federal Reserve Vice Chair for Supervision. Livestream link.

April 11, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases March producer worth inflation data.

Core PPI MoM Est. 0.3% vs. Prev. -0.1%

Core PPI YoY Est. 3.6% vs. Prev. 3.4%

PPI MoM Est. 0.2% vs. Prev. 0%

PPI YoY Est. 3.3% vs. Prev. 3.2%

April 14: Salvadoran President Nayib Bukele will probably be a part of U.S. President Donald Trump on the White House for an official working visit.

Earnings (Estimates based on FactSet data)

No earnings scheduled.

Token Events

Governance votes & calls

Bancor DAO is discussing the expansion of its taker fee to 0.001% on stable-to-stable trades on Sei v2 to make Carbon DeFi further aggressive.

April 9, 12 p.m.: Vana to host an X Spaces session on VRC-20 and the way in which ahead for decentralized data markets.

April 10, 10 a.m.: Hedera to host a community call discussing the HBR Foundation turning into a member of ERC3643, the non-profit’s necessities, and the Header Asset Tokenization Studio.

April 11, 3 p.m.: Zcash to host a metropolis hall on lockbox distribution & governance.

April 14, 10 a.m.: Stacks to host a livestream with present bulletins from the mission.

Unlocks

April 9: Movement (MOVE) to unlock 2.04% of its circulating present worth $15.25 million.

April 12: Aptos (APT) to unlock 1.87% of its circulating present worth $49.08 million.

April 12: Axie Infinity (AXS) to unlock 5.68% of its circulating present worth $20.73 million.

April 15: Starknet (STRK) to unlock 4.37% of its circulating present worth $15.71 million.

April 16: Arbitrum (ARB) to unlock 2.01% of its circulating present worth $25.31 million.

Token Listings

April 9: IOST airdrop claims portal for a roughly 1.7 billion IOST token airdrop to open.

April 10: Stacks (STX) to be listed on Bitfinex.

April 10: Ren (REN), KonPay (KON), and Symbol (XYM) to be delisted from Bybit.

April 22: Hyperlane to airdrop its HYPER tokens.

Conferences

CoinDesk’s Consensus is occurring in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

Day 2 of two: Digital Accord Summit 2025 (Paris)

Day 2 of three: Paris Blockchain Week

Day 1 of two: FIBE Fintech Festival Berlin 2025

Day 1 of two: Mexico Finance & Fintech Summit 2025 (Mexico City)

Day 1 of two: Middle East Resilient Banking and Payments Symposium 2025 (Abu Dhabi)

April 9: Blockchain & Finance – Evolution or Revolution? (Paris)

April 9: FinTech and Banking Unconference Colombia 2025 (Bogota)

April 10: Bitcoin Educators Unconference (Nashville)

April 10: FinXtex Malaysia 2025 (Kuala Lumpur)

April 10: Institutional Crypto Conference (New York)

April 10: SheFi Sumit 2025 (Seoul)

April 10-11: BITE-CON 2025 Conference (Miami)

April 10-11: 2025 Fintech and Financial Institutions Research Conference (Philadelphia)

April 11-12: Strategy’s OPNEXT Conference (Tysons, Va.)

April 12: Ethereum Argentina (Córdoba)

April 12-13: DeSci London 2025

Token Talk

By Shaurya Malwa

Confidential Balances, a new feature on Solana’s blockchain that lets people ship and deal with tokens privately, went energetic late Tuesday.

It makes use of zero-knowledge proofs (ZKPs), as a possibility to indicate one factor is true — equivalent to you have enough money to pay — without having to say exactly how lots you have gotten. It’s like exhibiting a locked discipline and proving the cash is inside with out opening it.

When tokens are despatched, the amount stays secret. Normally, on blockchains, all people can see how lots is being transferred. Here, solely the sender and receiver know the details.

The token stability (how lots you private) may also be saved private. Think of it like a checking account the place nobody nonetheless the proprietor can peek on the entire, in distinction to most blockchains the place balances are public.

This means the creation or destruction of tokens (minting and burning) can occur with out all people understanding the numbers. For occasion, a corporation may issue new tokens or take away some quietly, conserving the entire present under wraps.

The operate is constructed for privacy-focused financial apps, like payroll strategies or enterprise funds, the place contributors don’t want the portions to be made public. It’s an infinite deal for institutions that want privateness nonetheless nonetheless should adjust to pointers.

Derivatives Positioning

BTC futures open curiosity on offshore exchanges elevated as prices dropped all through Asian hours, validating the downtrend. The stage held common in the middle of the next restoration, suggesting a spot-led switch or absence of bullishness amongst spinoff retailers. The related is perhaps talked about in regards to the ETH market.

The open interest-adjusted cumulative amount delta for the very best 25 money, moreover BNB, SHIB, BCH and HBAR, is detrimental for the earlier 24 hours, a sign of internet selling stress in these markets.

BTC decisions transfer on Deribit has been blended with locations lifted along with put spreads and a notable block commerce involving a protracted place inside the $84K title expiring on April 25.

Market Movements

BTC is up 0.24% from 4 p.m. ET Tuesday at $77,232.03 (24hrs: -1.81%)

ETH is down 0.36% at $1,475.05 (24hrs: -5.66%)

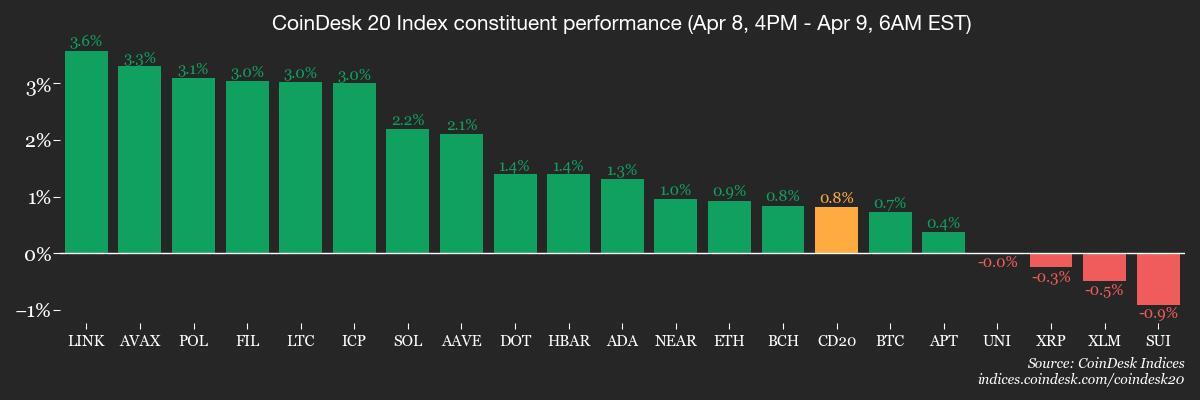

CoinDesk 20 is up 0.95% at 2,203.46 (24hrs: -3.04%)

Ether CESR Composite Staking Rate is unchanged at 3.69%

BTC funding charge is at -0.0018% (-1.9392% annualized) on Binance

DXY is down 0.68% at 102.25

Gold is up 3.19% at $3,063.20/oz

Silver is up 2.53% at $30.34/oz

Nikkei 225 closed -3.93% at 31,714.03

Hang Seng closed +0.68% at 20,264.49

FTSE is down 2.01% at 7,751.59

Euro Stoxx 50 is down 2.11% at 4,673.14

DJIA closed on Tuesday -0.84% at 37,645.59

S&P 500 closed -1.57% at 4,982.77

Nasdaq closed -2.15% at 15,267.91

S&P/TSX Composite Index closed -1.54% at 22,506.90

S&P 40 Latin America closed -2.24% at 2,177.30

U.S. 10-year Treasury charge is up 8 bps at 4.38%

E-mini S&P 500 futures are down 0.21% at 5,031.00

E-mini Nasdaq-100 futures are up 0.63% at 17,352.00

E-mini Dow Jones Industrial Average Index futures are unchanged at 37,857.00

Bitcoin Stats:

BTC Dominance: 63.40 (0.08%)

Ethereum to bitcoin ratio: 0.01916 (-0.73%)

Hashrate (seven-day shifting widespread): 925 EH/s

Hashprice (spot): $42.03

Total Fees: 7.88BTC / $622,998

CME Futures Open Interest: 429,112 BTC

BTC priced in gold: 25.3 oz

BTC vs gold market cap: 7.25%

Technical Analysis

BTC’s month-to-month candlesticks chart displays the cryptocurrency has practically retraced to the earlier resistance-turned-support stage at $73,757 (March 2024 extreme) in a conventional throwback pattern observed after bullish breakouts.

A bounce from that stage would signal a resumption of the broader uptrend.

Crypto Equities

Strategy (MSTR): closed on Tuesday at $237.95 (-11.26%), up 2.14% at $243.05 in pre-market

Coinbase Global (COIN): closed at $151.47 (-3.69%), up 0.45% at $152.15

Galaxy Digital Holdings (GLXY): closed at C$13.22 (+7.13%)

MARA Holdings (MARA): closed at $10.52 (-6.57%), up 0.67% at $10.59

Riot Platforms (RIOT): closed at $6.54 (-8.02%), up 1.22% at $6.62

Core Scientific (CORZ): closed at $6.51 (-7.26%), down 1.54% at $6.14

CleanSpark (CLSK): closed at $6.74 (-9.29%), up 0.89% at $6.80

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $11.49 (-7.41%), up 10.1% at $12.65

Semler Scientific (SMLR): closed at $31.97 (-6.38%), down 1.02% at $33.80

Exodus Movement (EXOD): closed at $40.14 (-4.06%)

ETF Flows

Spot BTC ETFs:

Daily internet transfer: -$326.3 million

Cumulative internet flows: $35.74 billion

Total BTC holdings ~ 1.11 million.

Spot ETH ETFs

Daily internet transfer: -$3.3

Cumulative internet flows: $2.37 billion

Total ETH holdings ~ 3.38 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

The chart displays gyrations inside the U.S. 10-year yield and the Nasdaq futures this month.

Since Friday, the 10-year yield has surged over 50 basis components whatever the continued weak level in Nasdaq.

The rising yield presents an issue to the Trump administration which wishes to lower it to help deal with its debt load.

While You Were Sleeping

Exclusive: China to Hold High-Level Meeting in Response to U.S. Tariffs, Say Sources (Reuters): Policymakers are anticipated to weigh export tax breaks, market assist and steps to lift consumption as Beijing responds to the 104% U.S. tariff on Chinese imports.

Argentina’s Congress Launches Probe Into LIBRA Fiasco (CoinDesk): Argentina’s lower dwelling accredited measures to analysis the LIBRA token, which prompted turmoil after being promoted by President Javier Milei earlier this 12 months.

Bitcoin Bears Eye $70K, Ether Drops 10% as Trump Tariffs Start Global Menace (CoinDesk): As Trump’s higher specific individual tariffs took affect, the sell-off in primary crypto tokens resumed, reversing constructive elements from Tuesday’s discount rally.

Treasuries ‘Fire Sale’ Sends Long-Term Yields Soaring Worldwide (Bloomberg): U.S. 30-year Treasury yields jumped 25 basis components as a result of the tariffs sparked a worldwide bond sell-off and an sudden drop inside the dollar, fueling concerns of waning abroad demand.

Argentina and IMF Reach $20 Billion Deal to Boost Free-Market Overhaul (The Wall Street Journal): The IMF talked about the deal, pending board approval, objectives to stabilize Argentina’s monetary system and assist long-term progress amid a dangerous worldwide backdrop.

In the Ether

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More