Crypto Daybook Americas, Crypto Daybook Americas Your day-ahead search for March 10, 2025

By Omkar Godbole (All instances ET except indicated in any other case)

The crypto market continues to lose floor, pushed by disappointment over the absence of a plan for the U.S. authorities to purchase bitcoin underneath the newly introduced strategic reserve plan and amid persistent macroeconomic concerns.

BTC fell to $80,000 late Sunday, buying and selling under the 200-day easy shifting common, and ether took out a macro bullish trendline with a dip under the long-held assist of $2,100. Other cash adopted the 2 majors, posting greater losses.

“Many investors are pulling out of bitcoin, viewing it as a risky asset class for the first time since Trump took the White House,” stated Zach Burks, CEO and founding father of NFT-service supplier Mintology. “It’s no longer playing its role as a store of value. Gold prices have spiked as many go back to the original ‘doomsday asset,’ which is no surprise as tariffs and grenades continues to get thrown across the free world.”

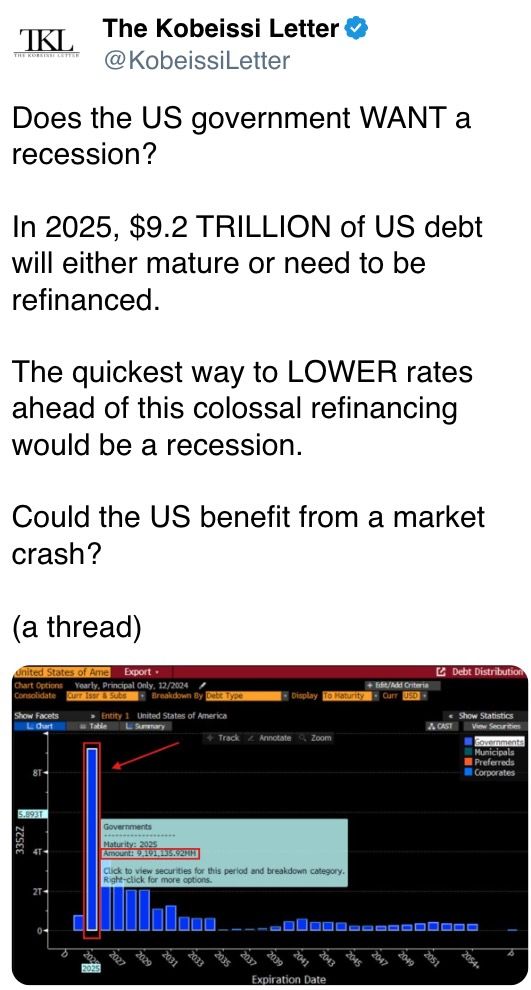

The tariffs are making it more durable for the Fed to maneuver ahead with price cuts regardless of the continued decline development in real-time inflation indicators. On Friday, Fed chairman Jerome Powell said the central financial institution is ready for larger readability on Trump’s insurance policies earlier than making the following transfer.

Meanwhile, Japan’s fastest base pay rise in 32 years strengthened the case for a BOJ price hike, pushing the nation’s bond yields and the yen greater. Bouts of power within the haven foreign money usually breed draw back volatility in danger property.

Still, some observers are not sure if the market weak spot, significantly seen over the weekend, may very well be long-lasting. “Trading volumes over the weekend were extremely low, reducing the value of the bearish signal,” Alex Kuptsikevich, the FxPro chief market analyst, instructed CoinDesk.

“We note that sellers push the price down in periods of low liquidity, but the price bounces back with the arrival of institutional buyers. It looks like the big buyers have enough liquidity left to buy out the drawdown,” Kuptsikevich stated. Stay alert!

What to Watch

Crypto:

March 10: Movement (MOVE), an Ethereum-based L2 blockchain, has its mainnet launch.

March 11, 9:00 a.m.: Horizen (ZEN) mainnet network upgrade to model ZEN 5.0.6 on the block top of 1,730,680.

March 11, 10:00 a.m.: U.S. House Financial Services Committee hearing a few federal framework for stablecoins and a U.S. CBDC. Livestream link.

March 11: The Bitcoin Policy Institute and U.S. Senator Cynthia Lummis co-host the invitation-only one-day occasion “Bitcoin for America” in Washington.

March 12: Hemi (HEMI), an L2 blockchain that operates on each Bitcoin and Ethereum, has its mainnet launch.

March 15: Athene Network (ATH) mainnet launch.

March 15: Reploy will shut its V1 RAI staking program to new customers because it transitions to a totally automated revenue-sharing protocol.

March 17.: CME Group launches solana (SOL) futures.

Macro

March 10, 7:50 p.m.: Japan’s Cabinet Office releases (remaining) This autumn GDP information.

GDP Growth Annualized Prev. 1.2%

GDP Growth Rate QoQ Est. 0.7% vs. Prev. 0.3%

March 11, 8:00 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases January industrial manufacturing information.

Industrial Production MoM Prev. -0.3%

Industrial Production YoY Prev. 1.6%

March 11, 10:00 a.m.: The U.S. Department of Labor releases January’s JOLTs report (job openings, hires, and separations).

Job Openings Est. 7.71M vs. Prev. 7.6M

Job Quits Prev. 3.197M

Earnings (Estimates based mostly on FactSet information)

March 17 (TBC): Bit Digital (BTBT), $-0.05

March 18 (TBC): TeraWulf (WULF), $-0.04

March 24 (TBC): Galaxy Digital Holdings (TSE: GLXY), C$0.39

Token Events

Governance votes & calls

GMX DAO is voting on the decentralization and automation of the fee distribution process for the GMX ecosystem to make sure “real-time, trustless, and verifiable fee allocations.”

Aavegotchi DAO is voting on utilizing the auto swapper contract to turn $2 million worth of stablecoins into GHST.

Frax DAO is discussing upgrading the protocol by renaming FXS to FRAX, making it the fuel token on Fraxtal, implementing the Frax North Star arduous fork and introducing a tail emission plan with step by step reducing emissions and different enhancements.

March 10, 9 a.m.: Waves to host an Ask Me Anything (AMA) session with founder Sasha Ivanov.

March 13, 10 a.m.: Mantra to host a Community Connect call with its CEO and Co-Founder to debate numerous main updates.

Unlocks

March 12: Aptos (APT) to unlock 1.93% of circulating provide value $62.09 million.

March 15: Starknet (STRK) to unlock 2.33% of its circulating provide value $10.25 million.

March 15: Sei (SEI) to unlock 1.19% of its circulating provide value $10.99 million.

March 16: Arbitrum (ARB) to unlock 2.1% of its circulating provide value $33.46 million.

March 18: Fasttoken (FTN) to unlock 4.66% of its circulating provide value $80 million.

March 21: Immutable (IMX) to unlock 1.39% of circulating provide value $13.13 million.

Token Listings

March 11: Bybit to delist Bancor (BNT), Paxos Gold (PAXG) and Threshold.

March 31: Binance to delist USDT, FDUSD, TUSD, USDP, DAI, AEUR, UST, USTC and PAXG.

Conferences

CoinDesk’s Consensus is going down in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

Day 1 of two: MoneyLIVE Summit (London)

Day 1 of three: AIBC Africa (Cape Town)

March 11-12: VanEck Southern California Blockchain Conference 2025 (Los Angeles)

March 13-14: Web3 Amsterdam ‘25

March 16, 6:00 p.m.: Solana AI Summit (San Jose, Calif.)

March 18-20: Digital Asset Summit 2025 (New York)

March 18-20: Fintech Americas Miami 2025

March 19-20: Next Block Expo (Warsaw)

March 24-26: Merge Buenos Aires

March 25-26: PAY360 2025 (London)

March 25-27: Mining Disrupt (Fort Lauderdale, Fla.)

March 26: Crypto Assets Conference (Frankfurt)

March 26: DC Blockchain Summit 2025 (Washington)

March 26-28: Real World Crypto Symposium 2025 (Sofia, Bulgaria)

March 27: Building Blocks (Tel Aviv)

March 27: Digital Euro Conference 2025 (Frankfurt)

March 27: WIKI Finance EXPO Hong Kong 2025

March 27-28: Money Motion 2025 (Zagreb, Croatia)

March 28: Solana APEX (Cape Town)

Token Talk

By Shaurya Malwa

Zerebro (ZEREBRO), as soon as a celebrated AI agent token, has crashed 96% from its January peak market cap of above $800 million to simply $33.5 million.

AI agent tokens had been among the many hottest sectors in October and November, seeing speedy listings by exchanges and promotion by influencers on the narrative of a confluence between crypto and synthetic intelligence.

Zerebro created its personal music album and supplied NFTs to followers, with plans of introducing a platform that enables token holders to launch their very own AI brokers. It reached over 120,000 followers on X in a brief interval.

Fundamentals stay sturdy, nevertheless, providing hope for these trying to spend money on AI agent tokens. The venture was chosen as one of many validators for IP-focused blockchain Story last week, taking part in a task in a future financial system that’s wholly run by AI brokers and machines.

A validator is a essential participant in a blockchain community, accountable for verifying and validating transactions and blocks to make sure the safety and consensus of any community.

Story Protocol validators have particular obligations tailor-made to the protocol’s mission of managing and monetizing mental property on a blockchain, and the validators are paid in return for guaranteeing the community retains functioning.

Derivatives Positioning

Perpetual funding charges in BTC, SOL, ADA, XRP and TRX have flipped detrimental, pointing to a bias for shorts because the market wilts.

Open curiosity in futures tied to BNB, HYPE, OM and DOT has elevated prior to now 24 hours, an indication of merchants shorting in a falling market.

On Deribit, merchants have snapped places at $85K and $80K strikes whereas lengthy positions within the $75K put rolled out or moved to June expiry.

ETH places have been in demand as effectively, buying and selling at a premium to calls out to June expiry.

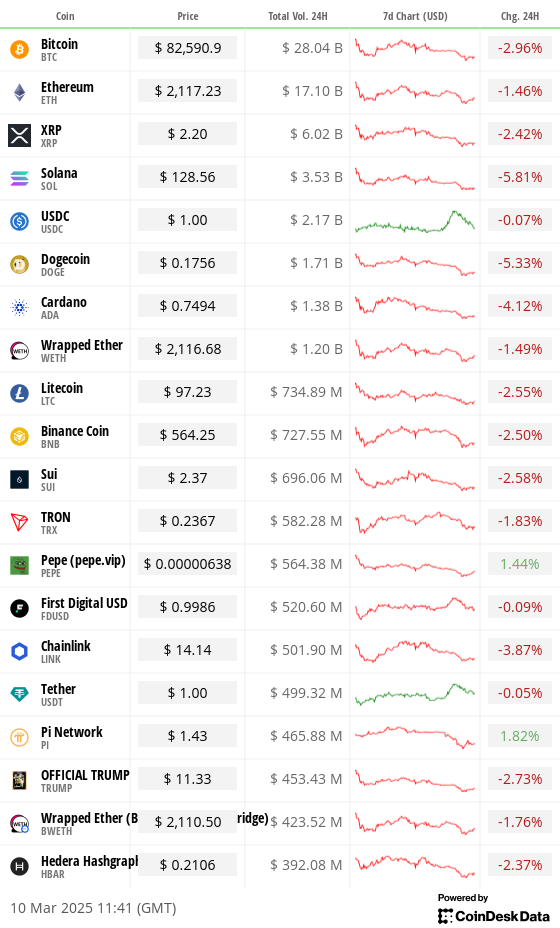

Market Movements:

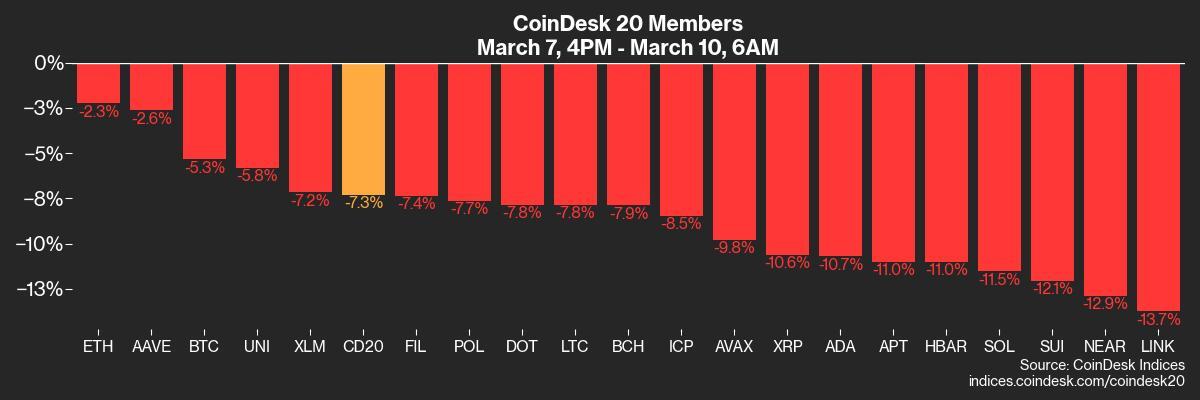

BTC is down 4.61% from 4 p.m. ET Friday at $82,373.88 (24hrs: -3.21%)

ETH is down 1.6% at $2,101.66 (24hrs: -2.04%)

CoinDesk 20 is down 6.4% at 2,632.12 (24hrs: -3.26%)

Ether CESR Composite Staking Rate is down 8 bps at 3%

BTC funding price is at 0.0015% (1.67% annualized) on Binance

DXY is down 0.14% at 103.76

Gold is up 0.15% at $2,909.10/oz

Silver is up 1.14% at $32.92/oz

Nikkei 225 closed +0.38% at 37,028.27

Hang Seng closed -1.85% at 23,783.49

FTSE is down 0.59% at 8,629.02

Euro Stoxx 50 is down 0.96% at 5,415.85

DJIA closed on Friday +0.52% at 42,801.72

S&P 500 closed +0.55% at 5,770.20

Nasdaq closed +0.7% at 18,196.22

S&P/TSX Composite Index closed +0.71% at 24,758.80

S&P 40 Latin America closed +0.73% at 2,361.82

U.S. 10-year Treasury price is down 5 bps at 4.25%

E-mini S&P 500 futures are down 1.16% at 5,709.25

E-mini Nasdaq-100 futures are down 1.34% at 19,958.25

E-mini Dow Jones Industrial Average Index futures are down 0.96% at 42,428.00

Bitcoin Stats:

BTC Dominance: 61.19 (-0.14%)

Ethereum to bitcoin ratio: 0.02562 (2.40%)

Hashrate (seven-day shifting common): 813 EH/s

Hashprice (spot): $48.2

Total Fees: 4.4 BTC / $371,994

CME Futures Open Interest: 142,260 BTC

BTC priced in gold: 28.2 oz

BTC vs gold market cap: 8.01%

Technical Analysis

BTC has dived under a pennant sample, hinting on the continuation of the broader decline from December highs.

The breakdown has strengthened the case for a retest of the previous resistance-turned-support at round $73,800, the March 2024 excessive.

A pennant is a continuation sample, representing a mid-trend triangular consolidation.

Crypto Equities

Strategy (MSTR): closed on Friday at $287.18 (-5.57%), down 5.33% at $271.87 in pre-market

Coinbase Global (COIN): closed at $217.45 (+1.53%), down 5.36% at $205.79

Galaxy Digital Holdings (GLXY): closed at C$18.84 (+0.11%)

MARA Holdings (MARA): closed at $16.02 (+6.16%), down 4.24% at $15.34

Riot Platforms (RIOT): closed at $8.37 (+3.21%), down 4.42% at $8

Core Scientific (CORZ): closed at $7.78 (-0.89%), down 2.7% at $7.57

CleanSpark (CLSK): closed at $8.83 (+8.34%), down 3.85% at $8.49

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $16.32 (+3.29%), down 6.25% at $15.30

Semler Scientific (SMLR): closed at $37.19 (+3.02%), down 3.47% at $35.90

Exodus Movement (EXOD): closed at $29.40 (+0.34%), up 6.22% in pre-market

ETF Flows

Spot BTC ETFs:

Daily internet circulate: -$409.3 million

Cumulative internet flows: $36.21 billion

Total BTC holdings ~ 1,137 million.

Spot ETH ETFs

Daily internet circulate: -$23.1 million

Cumulative internet flows: $2.72 billion

Total ETH holdings ~ 3.635 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

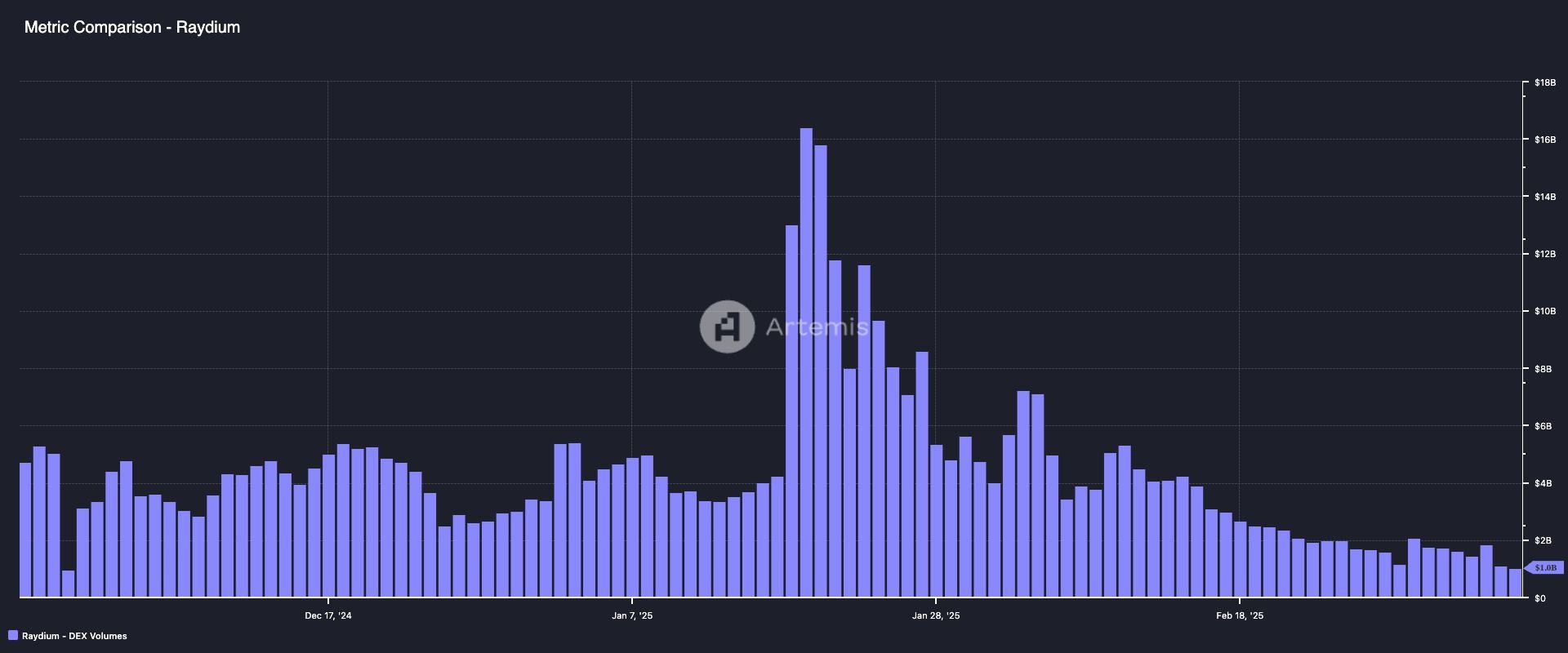

The chart exhibits the day by day quantity on Solana’s decentralized change Raydium has dropped to $1 billon, the bottom since Nov. 29 and considerably under the Jan. 19 peak of $16.4 billion.

The sharp decline in exercise helps clarify the worth swoon in Solana’s SOL token.

While You Were Sleeping

Howard Lutnick Plays Down Recession Fears as BTC Lingers in $80K Range (CoinDesk): Commerce Secretary Howard Lutnick dismissed recession issues, saying Trump’s tariff technique will drive $1.3 trillion in funding and enhance U.S. progress.

Ether’s 20% Plunge Shatters Bull Market Trendline Created After 2022 Terra Crash (CoinDesk): ETH’s posted its worst weekly drop since November 2022, breaking a bullish trendline from mid-2022 and signaling the potential for additional losses.

Stablecoin Market Cap Tops $200B as U.S. Sees Industry Helping Maintain Dollar Dominance (CoinDesk): U.S. Treasury Secretary Scott Bessent stated stablecoins will assist maintain the greenback as the highest reserve foreign money.

Oil Prices Decline As Tariff Uncertainty Keeps Investors on Edge (Reuters): Oil costs fell as uncertainty over U.S. tariffs, issues about American financial progress, rising OPEC+ manufacturing, Saudi value cuts and deflationary pressures from China weighed on sentiment.

Trump Declines to Rule Out Recession (The Wall Street Journal): In a Sunday interview, the U.S. president acknowledged his insurance policies, together with tariffs and price range cuts, could trigger near-term instability however maintained they’d strengthen the financial system over time.

Japan 10-Year Yield at Highest Since 2008 on Bets for BOJ Hikes (Bloomberg): Strong wage progress and weak demand at a current authorities debt public sale strengthened expectations for a Bank of Japan interest-rate enhance, with markets pricing in an 85% probability by July.

In the Ether

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More