Crypto Daybook Americas, Crypto Daybook Americas Your day-ahead search for April 8, 2025

By James Van Straten (All instances ET except indicated in any other case)

One factor markets despise is uncertainty, and proper now it is coming from all corners of the globe, largely fueled by Trump’s tariffs.

Markets rebounded considerably on Tuesday following Monday’s massacre in Asia and Europe, however it was extra of a reduction rally than a real restoration. At the center of the battle are the U.S. and China, each refusing to be the primary to blink — even when it means extended uncertainty and ache for world markets.

As markets took a breather from the turmoil, crypto skeptics had been fast to level out how bitcoin’s (BTC) secure haven narrative — bolstered by its resilience late final week — shortly unraveled on Monday when the value crashed to $75,000.

While that’s true, anticipating the bitcoin value to stay unaffected was overly optimistic. During crises buyers traditionally rush to money, liquidating even conventional havens investments similar to gold. Monday was no exception. Still, bitcoin has proven decrease beta than U.S. equities for the reason that tariff announcement.

In the larger image, bitcoin is holding up pretty effectively. The Nasdaq is down over 22% from its all-time excessive, whereas bitcoin is off by 28%. In earlier episodes — just like the yen carry-trade unwind in August 2024 or the COVID crash in March 2020 — bitcoin suffered far deeper relative losses.

Since the New York market closed on Wednesday, BTC has declined 8.4%, outperforming the S&P 500’s 10% drop and the Nasdaq’s 11% fall.

“What matters is that BTC’s beta to broader risk assets appears meaningfully lower in this sell-off than in previous ones. This suggests a growing recognition of bitcoin’s potential role as a non-sovereign store of value during periods of economic stress,” David Lawant, head of analysis at FalconX, stated in an e mail.

Monday’s buying and selling session additionally included an episode of “short-term madness” pushed by false reviews a couple of 90-day tariff delay. The markets spiked after which promptly crashed again down after the reviews had been refuted. Stay alert!

What to Watch

Crypto:

April 8: Teucrium 2x Long Daily XRP ETF (XXRP) lists on NYSE Arca.

April 9: The Mercury network upgrade will get utilized to the Neutron (NTRN) mainnet, migrating it from Cosmos Hub’s Interchain Security to a totally sovereign proof-of-stake community.

April 9, 10 a.m.: U.S. House Financial Services Committee hearing on updating U.S. securities legal guidelines to keep in mind digital property. Livestream link.

April 10, 10:30 a.m.: Status conference for former Terraform Labs CEO Do Kwon on the U.S. District Court for the Southern District of New York.

April 11, 1 p.m.: U.S. SEC Crypto Task Force Roundtable on “Tailoring Regulation for Crypto Trading” in Washington.

Macro

April 9, 12:01 a.m.: The Trump administration’s higher individualized tariffs on imports from prime U.S. commerce deficit international locations take impact.

April 9, 8:00 a.m.: Mexico’s Instituto Nacional de Estadística y Geografía (INEGI) releases March shopper value inflation information.

Core Inflation Rate MoM Prev. 0.48%

Core Inflation Rate YoY Prev. 3.65%

Inflation Rate MoM Prev. 0.28%

Inflation Rate YoY Prev. 3.77%

April 9, 12:01 p.m.: China’s 34% retaliatory tariffs on U.S. imports take impact.

April 9, 2:00 p.m.: The Fed releases minutes of the FOMC assembly held March 18-19.

April 9. 8, 9:30 p.m.: China’s National Bureau of Statistics (NBS) releases March’s Consumer Price Index (CPI) report.

Inflation Rate MoM Prev. -0.2%

Inflation Rate YoY Est. 0% vs. Prev. -0.7%

PPI YoY Est. -2.3% vs. Prev. -2.2%

April 10, 10:00 a.m.: U.S. Senate Banking Committee hearing on the nomination of Michelle Bowman as Federal Reserve Vice Chair for Supervision. Livestream link.

April 14: Salvadoran President Nayib Bukele will be a part of U.S. President Donald Trump on the White House for an official working visit.

Earnings (Estimates primarily based on TruthSet information)

No earnings scheduled.

Token Events

Governance votes & calls

Uniswap DAO is discussing a proposal to support v4 expansion with the creation of ENS subdomains to trace BSL license exemptions and official deployments, granting the Uniswap Foundation a blanket license to deploy v4 on track chains.

Bancor DAO is discussing the expansion of its taker fee to 0.001% on stable-to-stable trades on Sei v2 to make Carbon DeFi extra aggressive.

April 8, 12 p.m.: Lido to host a Lido Node Operator Community Call.

April 10, 10 a.m.: Hedera to host a community call discussing the HBR Foundation becoming a member of ERC3643, the non-profit’s requirements, and the Header Asset Tokenization Studio.

April 11, 3 p.m.: Zcash to host a city corridor on lockbox distribution & governance.

April 14, 10 a.m.: Stacks to host a livestream with latest bulletins from the undertaking.

Unlocks

April 8: Tensor (TNSR) to unlock 35.96% of its circulating provide value $14.44 million.

April 9: Movement (MOVE) to unlock 2.04% of its circulating provide value $15.84 million.

April 12: Aptos (APT) to unlock 1.87% of its circulating provide value $51.01 million.

April 12: Axie Infinity (AXS) to unlock 5.68% of its circulating provide value $21.18 million.

April 15: Starknet (STRK) to unlock 4.37% of its circulating provide value $15.79 million.

April 16: Arbitrum (ARB) to unlock 2.01% of its circulating provide value $25.22 million.

Token Listings

April 8: Avalanche (AVAX) to be listed on Coins.ph.

April 9: IOST airdrop claims portal for a roughly 1.7 billion IOST token airdrop to open.

April 10: Ren (REN), KonPay (KON), and Symbol (XYM) to be delisted from Bybit.

April 22: Hyperlane to airdrop its HYPER tokens.

Conferences

CoinDesk’s Consensus is going down in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

Day 1 of two: Digital Accord Summit 2025 (Paris)

Day 1 of three: Paris Blockchain Week

April 8: Seine & Crypto Connect (Paris)

April 9: Blockchain & Finance – Evolution or Revolution? (Paris)

April 9: FinTech and Banking Unconference Colombia 2025 (Bogota)

April 9-10: FIBE Fintech Festival Berlin 2025

April 9-10: Mexico Finance & Fintech Summit 2025 (Mexico City)

April 9-10: Middle East Resilient Banking and Payments Symposium 2025 (Abu Dhabi)

April 10: Bitcoin Educators Unconference (Nashville)

April 10: FinXtex Malaysia 2025 (Kuala Lumpur)

April 10: Institutional Crypto Conference (New York)

April 10: SheFi Sumit 2025 (Seoul)

April 10-11: BITE-CON 2025 Conference (Miami)

April 10-11: 2025 Fintech and Financial Institutions Research Conference (Philadelphia)

April 11-12: Strategy’s OPNEXT Conference (Tysons, Va.)

April 12: Ethereum Argentina (Córdoba)

April 12-13: DeSci London 2025

Token Talk

By Shaurya Malwa

Fartcoin (FART) jumped 30% to increase month-to-month good points over 130%.

The absurdly-named token prolonged a multiday run the broader crypto market staged a reduction rally, displaying indicators of regular shopping for demand from merchants.

Speculators keep watch over continuous energy in memecoins, particularly once they are inclined to buck market developments, as a result of the tokens have a tendency to leap larger after a sell-off available in the market. This can create doable revenue alternatives for short-term merchants, with some eyeing a transfer larger for the token in coming weeks.

FART, amongst some crypto circles, is a logo of the absurd and a light-hearted rebel towards the grim monetary forecasts. It holds no intrinsic worth, however enjoys a cult following — presumably driving shopping for demand even because the market falls.

Derivatives Positioning

Bitcoin CME futures foundation is holding agency above an annualized 5% amid the macro turmoil.

CME choices skew, nonetheless, is exhibiting bias for draw back safety, or places.

Together, each metrics present cautious sentiment with out signaling panic, in response to Thomas Erdösi, head of product at CF Benchmarks.

On Deribit, BTC and ETH put biases have moderated, however BTC implied volatility time period construction stays in backwardation, indicating persistent fears of untamed value swings within the short-term.

In BTC choices, the $70K put is now the most well-liked strike, boasting a notional open curiosity of $957 million. That’s a 180-degree shift from the bias for $100K-$120K strike calls early this yr.

Most of the highest 25 cash, excluding TRX, HBAR, LINK and DOT, have seen a drop in perpetual futures open curiosity up to now 24 hours.

Market Movements

BTC is unchanged from 4 p.m. ET Monday at $78,894.34 (24hrs: +2.61%)

ETH is down 0.32% at $1,514.40 (24hrs: +5.22%)

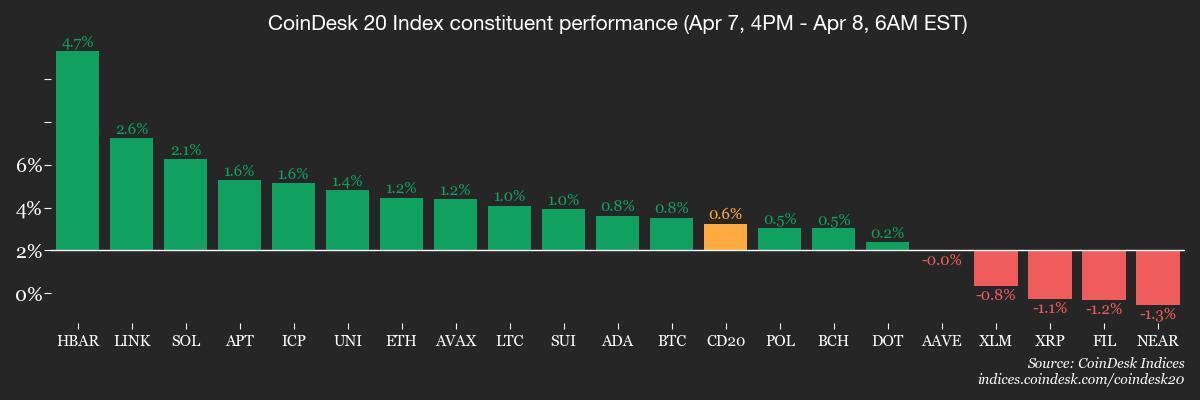

CoinDesk 20 is up 0.8% at 2,268.01 (24hrs: +4.76%)

Ether CESR Composite Staking Rate is up 77 bps at 3.69%

BTC funding charge is at 0.0049% (5.3118% annualized) on Binance

DXY is unchanged at 103.32

Gold is up 2.19% at $3015.9/oz

Silver is up 1.9% at $30.07/oz

Nikkei 225 closed +6.03% at 33,012.58

Hang Seng closed +1.51% at 20,127.68

FTSE is up 2.1% at 7,863.79

Euro Stoxx 50 is up 1.36% at 4,719.66

DJIA closed on Monday -0.91% at 37,965.60

S&P 500 closed -0.23% at 5,062.25

Nasdaq closed +0.1% at 15,603.26

S&P/TSX Composite Index closed -1.44% at 22,859.50

S&P 40 Latin America closed -2.94% at 2,227.14

U.S. 10-year Treasury charge is down 2 bps at 4.16%

E-mini S&P 500 futures are down 1.58% at 5,178.00

E-mini Nasdaq-100 futures are up 1.35% at 17,799.50

E-mini Dow Jones Industrial Average Index futures are up 2% at 38,930.00

Bitcoin Stats:

BTC Dominance: 63.46 (-0.11%)

Ethereum to bitcoin ratio: 0.01980 (0.97%)

Hashrate (seven-day transferring common): 902 EH/s

Hashprice (spot): $40.50

Total Fees: 6.59BTC / $510,645

CME Futures Open Interest: 137,695 BTC

BTC priced in gold: 26.2 oz

BTC vs gold market cap: 7.43%

Technical Analysis

The chart reveals month-to-month exercise within the U.S. 10-year Treasury yield for the reason that Eighties.

While the crypto neighborhood is hoping for a return to the zero-yield period, the chart suggests in any other case, revealing a long-term bullish shift in charges.

The development change is clear from the important thing 50-, 100- and 200-month easy transferring averages — that are aligned bullishly one above the opposite for the primary time for the reason that Eighties.

Elevated charges could be the brand new regular.

Crypto Equities

Strategy (MSTR): closed on Monday at $268.14 (-8.67%), up 1.47% at $272.09 in pre-market

Coinbase Global (COIN): closed at $157.28 (-2.04%), up 1.72% at $159.98

Galaxy Digital Holdings (GLXY): closed at C$12.34 (-8.8%)

MARA Holdings (MARA): closed at $11.26 (-0.35%), up 2.04% at $11.49

Riot Platforms (RIOT): closed at $7.11 (-0.42%), up 0.28% at $7.13

Core Scientific (CORZ): closed at $7.02 (-2.23%), up 1.85% at $7.15

CleanSpark (CLSK): closed at $7.43 (+1.5%), up 0.67% at $7.48

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $12.41 (+0.73%)

Semler Scientific (SMLR): closed at $34.15 (0.89%), down 1.02% at $33.80

Exodus Movement (EXOD): closed at $41.84 (-6.25%), down 5.16% at $39.68

ETF Flows

Spot BTC ETFs:

Daily internet stream: -$103.9 million

Cumulative internet flows: $36.07 billion

Total BTC holdings ~ 1.11 million.

Spot ETH ETFs

Daily internet stream: $0.0

Cumulative internet flows: $2.38 billion

Total ETH holdings ~ 3.37 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

The chart by CryptoQuant reveals each day internet stream of BTC from wallets linked with miners.

On Monday, these wallets registered a cumulative internet outflow of 1,627 BTC, probably the most since Dec. 24.

According to Bloomberg, the Trump tariffs have disrupted the bitcoin mining business.

While You Were Sleeping

China Offers First Hint of Devaluation With Weak Renminbi Fix (Financial Times): China set the yuan-dollar charge at its lowest degree since September 2023 to counter mounting U.S. tariffs. Analysts say important devaluation is unlikely.

First XRP ETF in the U.S. to Go Live on Tuesday With Launch of Teucrium’s Leveraged Fund (CoinDesk): The Teucrium 2x Long Daily XRP ETF lists on NYSE Arca with the ticker XXRP, giving publicity to XRP with 2x leverage. Management price: 1.85%.

Cboe Set to Debut New Bitcoin Futures With FTSE Russell (CoinDesk): Cboe Digital plans to introduce a cash-settled bitcoin futures contract April 28.

WazirX Creditors Back Restructuring Plan to Payback $230M Hack Victims (CoinDesk): If accredited by the Singapore High Court, the scheme will provoke payouts inside 10 enterprise days adopted by phased resumptions of withdrawals and buying and selling, topic to regulatory compliance.

Russia’s Medvedev Predicts More Countries Will Acquire Nuclear Weapons (Reuters): Russia’s Security Council deputy chair stated nuclear disarmament is now not possible, even when the Ukraine conflict ends.

Trump Order Seeks to Tap Coal Power in Quest to Dominate AI (Bloomberg): Trump is ready to signal an government order directing two federal companies to ease coal mining limits and label the gas a important mineral for nationwide safety.

In the Ether

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More